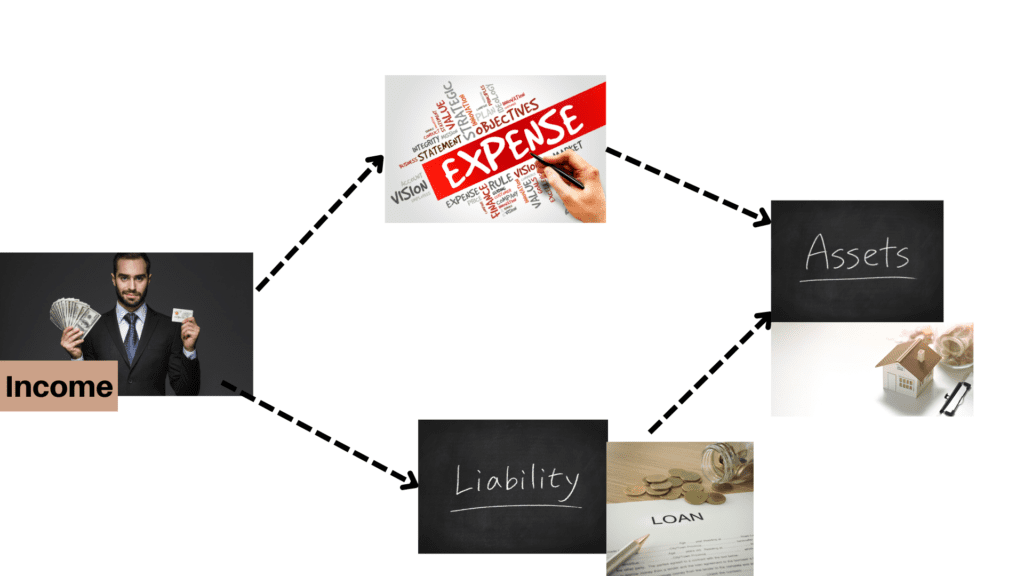

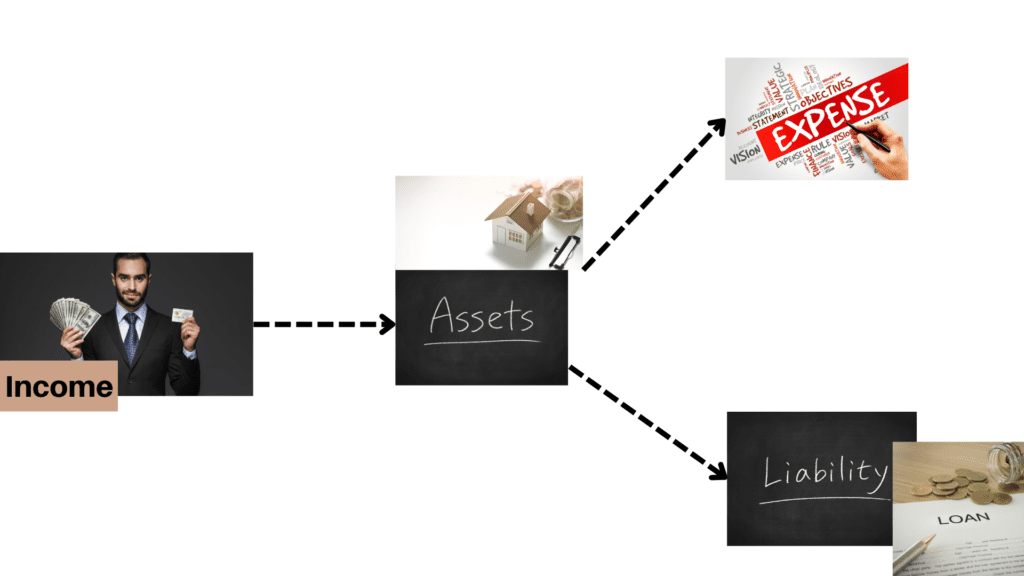

In the realm of business and innovation, Clayton M. Christensen’s “The Innovator’s Dilemma” emerges as a pivotal text, offering insights into managing disruptive technologies. Two standout examples of companies that have successfully navigated the landscape of disruptive innovation, as outlined by Christensen, are Netflix and Amazon.

Netflix: Rewriting the Rules of Entertainment

- Embracing Disruptive Technology: Netflix began as a DVD rental service, targeting a niche market of early DVD adopters. This initial focus on a small, specific customer base set the stage for future growth.

- Adapting to Market Evolution: With the advent of streaming technology, Netflix transitioned from DVDs to streaming, initially a less superior technology. This strategic shift catered to a growing desire for on-demand entertainment.

- Anticipating Consumer Needs: Understanding the importance of convenience and evolving preferences, Netflix invested early in streaming, positioning themselves ahead of market trends.

- Separating New Ventures: Netflix’s foray into streaming was effectively a creation of a new business unit, allowing it to flourish without constraints from the DVD rental model.

- Innovating in Response to Market Changes: As streaming gained popularity, Netflix pivoted again, this time into content creation, in response to changes in content licensing and to differentiate from emerging competitors.

- Self-Disruption for Sustained Success: Netflix’s willingness to move away from the successful DVD rental model to focus on streaming exemplifies the principle of self-disruption, a key tenet of Christensen’s theory.

Amazon: From Books to the Cloud

- Starting Small and Scaling Up: Amazon’s journey began with online book sales, a move that circumvented direct competition with larger, established bookstores.

- Utilizing Emerging Technologies: Leveraging the internet, Amazon transformed the retail experience, offering a broader selection and greater convenience.

- Expanding Based on Customer Feedback: Amazon’s expansion into diverse product categories was driven by customer insights and market trends.

- Entering Adjacent Markets: The development of a logistics network for e-commerce allowed Amazon to venture into new services like Amazon Prime.

- Early Adoption of Disruptive Tech: Amazon Web Services (AWS) marked Amazon’s entry into cloud computing, targeting initially small- and medium-sized businesses and eventually dominating the sector.

- Ongoing Self-Disruption: Amazon continually reinvents its offerings, as seen in the development of the Kindle, which disrupted their own physical book sales.

- Building a Robust Ecosystem: The creation of an extensive ecosystem, encompassing e-commerce, cloud computing, and AI technologies, has been instrumental in Amazon’s resilience and continual innovation.

Both Netflix and Amazon exemplify the principles of “The Innovator’s Dilemma.” Their stories of continuous adaptation, anticipation of market shifts, and willingness to disrupt themselves highlight the importance of embracing disruptive technologies and maintaining a culture of innovation. These cases provide valuable insights for any company looking to lead in times of technological disruption and market evolution.

Research references: Formal case studies and articles.

- Netflix: Harvard Business School’s insightful case study on Netflix is a treasure trove for anyone interested in understanding disruptive innovation in the digital era. It delves into the visionary approach of Reed Hastings in founding Netflix, aiming to revolutionize the home movie experience beyond the traditional retail rental model. This deep dive explores the critical strategic shifts Netflix made that challenged and ultimately transformed the retail video rental landscape. By leveraging a vast national inventory, a sophisticated recommendation system, and a broad customer base, Netflix didn’t just adapt to the video-on-demand challenge; it redefined it. This case study is a must-read for understanding how Netflix’s innovative strategies disrupted an entire industry, showcasing the principles of disruptive innovation in action. Refer: Netflix – Case – Faculty & Research – Harvard Business School (hbs.edu)

- Amazon : Harvard Business School’s comprehensive case study on Amazon offers a riveting look into the company’s extraordinary growth and diversification. The study meticulously examines Amazon’s foray into diverse sectors, notably healthcare and autonomous vehicles, highlighting the strategic challenges and triumphs along the way. Aligning with the disruptive innovation model, this case study encapsulates Amazon’s journey up to early 2021, including the pivotal moment when founder Jeff Bezos transitioned from CEO. It provides a rich analysis of Amazon’s strategic decisions, e-commerce evolution, cloud computing ventures, and other key facets of its multifaceted business model, making it a valuable resource for understanding modern business strategy and innovation. Refer: Amazon.com, 2021 – Case – Faculty & Research – Harvard Business School (hbs.edu)