Introduction

Hey there, future financial maestros! Are you ready to dive into the world of smart money management? Today, we’re not just talking about saving pennies; we’re exploring how to manage your money like the wealthy. This skill is crucial for anyone aiming to achieve financial independence and is often overlooked in our education. Let’s unravel the secrets to handling your finances with wisdom and foresight.

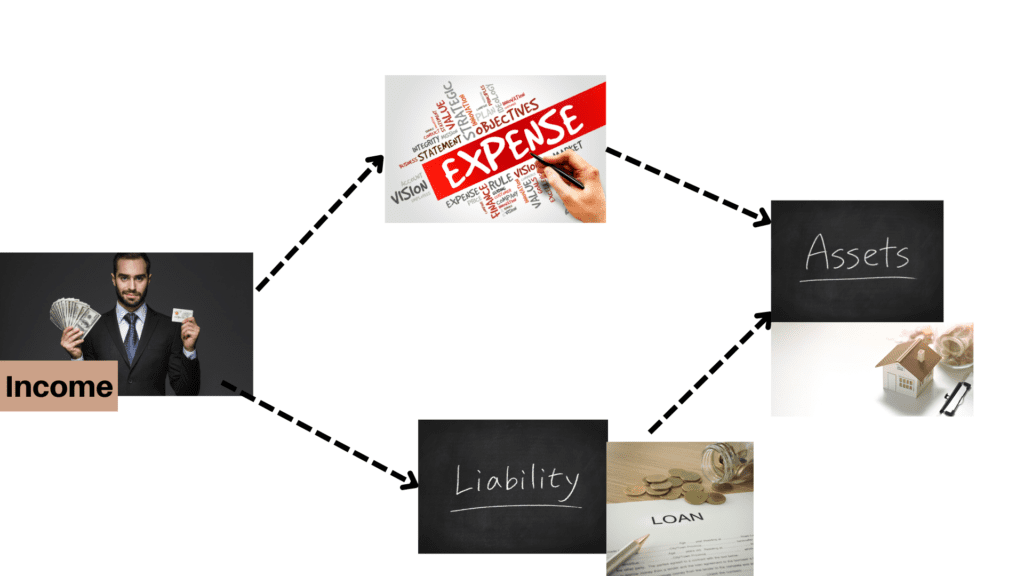

The old Middle-Class Way of Money Management

In the typical middle-class money management scenario, most people earn income and immediately spend it on goods, services, and liabilities like credit card debts and home loans. There’s often a pattern of investing in assets with whatever little is left after expenses. This approach, unfortunately, hampers the growth of wealth-building assets and keeps many in a financial rut.

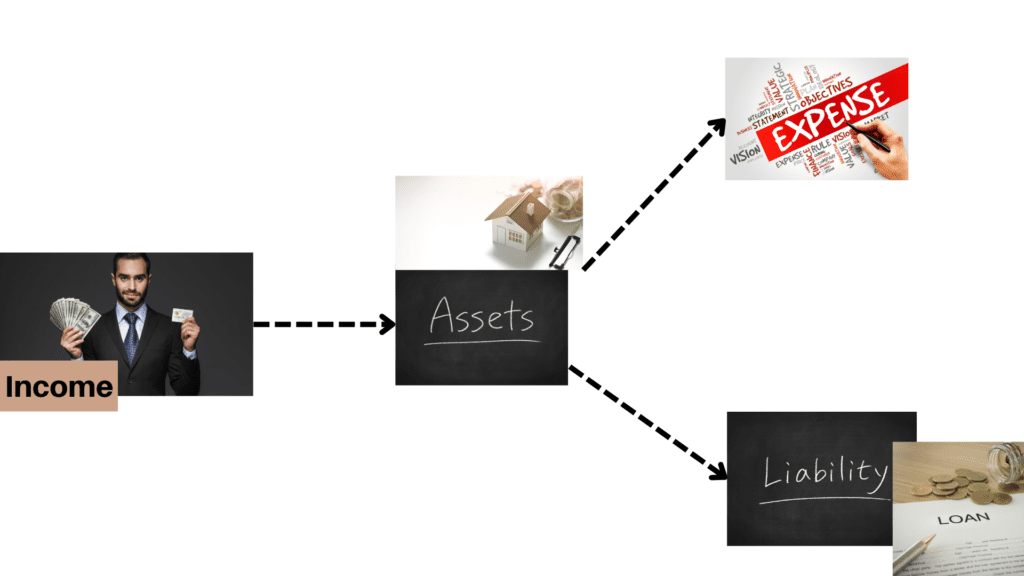

The Wealthy Way: Pay Yourself First

So, how do the wealthy do it differently? It’s all about priorities:

- Prioritize Asset Accumulation: When income rolls in, the wealthy focus first on buying assets. This could be stocks, real estate, or any avenue that promises growth.

- Manage Expenses and Liabilities: After securing assets, they then manage their expenses and liabilities, often minimizing unnecessary expenditures.

- Reinvesting Asset Gains: The golden rule here is to reinvest the returns from these assets into buying more, steering clear of the trap of increasing expenses with rising income.

Robert Kiyosaki’s Concept

The concept of “Pay Yourself First” is one of the cornerstone principles in Robert Kiyosaki’s “Rich Dad Poor Dad.” This idea challenges traditional personal finance advice and focuses on a key aspect of wealth building. Here’s a deeper look into what it means:

The Basic Premise

- Traditional Approach: Usually, when people receive their income, they first pay their bills and expenses and then save whatever is left. This approach often leads to little or no savings, as expenses tend to expand to consume the available income.

- Pay Yourself First: In contrast, the “Pay Yourself First” method advocates for setting aside a portion of your income for savings or investment before paying your bills and other expenses. It’s essentially treating your savings and investment accounts as the most important ‘bills’ you pay each month.

The Underlying Philosophy

- Financial Discipline: This strategy requires discipline and a strong commitment to your financial goals. It’s about prioritizing long-term financial health over immediate spending.

- Forced Savings and Investment: By saving or investing first, you’re effectively forcing yourself to save and potentially grow your wealth, rather than leaving saving as an afterthought.

Practical Implementation

- Budgeting: Determine a realistic percentage or amount of your income that you can save or invest each month. This should be done after considering your basic needs but before any discretionary spending.

- Automated Savings: Automating this process can be highly effective. Set up automatic transfers to a savings account or investment portfolio right when your paycheck arrives.

The Long-Term Impact

- Wealth Building: Over time, this practice can lead to significant accumulation of savings and investments, contributing to wealth building.

- Financial Discipline: It also instills a habit of living within or below your means, which is crucial for long-term financial stability.

Criticisms and Considerations

- Real-Life Challenges: Critics point out that for many people, especially those with low incomes, paying themselves first might not be feasible due to tight budgets and necessary expenses.

- Flexible Approach: It’s important to adapt this principle to individual circumstances. For some, it might mean saving a small percentage initially and gradually increasing it.

The Path to Financial Freedom

The ultimate goal? Building a solid asset column. The dream is to have your assets eventually generate enough income to cover your expenses. This means investing more in assets and cutting down on non-essential spending. It’s about setting yourself on the path to financial freedom, where your assets work for you, not the other way around.

Conclusion

Mastering wealth isn’t just about saving or investing; it’s about restructuring your financial priorities to build a sustainable and prosperous future. Remember, managing money is a journey, not a destination. Be patient with yourself and celebrate the small victories along the way. With these strategies in hand, you’re well on your way to becoming a money management pro. Here’s to a brighter, more secure financial future!