In today’s digital age, the possibilities for monetizing your products are endless. Whether you have a software platform, an e-book, or a mobile app, unlocking their power can lead to significant financial gains. But how exactly can you capitalize on these digital products and boost your revenue? This comprehensive guide will show you the way.

Throughout this article, we will explore innovative strategies and proven techniques to help you monetize your digital products effectively. From choosing the right pricing model to implementing a successful marketing campaign, we will cover it all.

From subscription-based memberships to one-time purchases, we’ll examine different monetization models and their pros and cons. We’ll also dive into the world of upselling and cross-selling, exploring strategies to increase your average order value and enhance customer satisfaction. Plus, we’ll discuss the importance of data analytics and how it can inform your monetization strategy.

Don’t let your digital products go untapped. Let’s unlock their power and take your revenue to new heights.

Monetization

In today’s digital age, the possibilities for monetizing your products are endless. Whether you have a software platform, an e-book, or a mobile app, unlocking their power can lead to significant financial gains. But how exactly can you capitalize on these digital products and boost your revenue? This comprehensive guide will show you the way.

Throughout this article, we will explore innovative strategies and proven techniques to help you monetize your digital products effectively. From choosing the right pricing model to implementing a successful marketing campaign, we will cover it all.

Why digital products are a lucrative business opportunity.

Digital products have transformed the way we consume and interact with content. Unlike physical products, digital products can be replicated and distributed at a low cost, making them an attractive option for entrepreneurs and businesses alike. Whether it’s an e-learning course, a software tool, or a digital artwork, the scalability and potential for automation make digital products a lucrative business opportunity.

One of the key advantages of digital products is their ability to generate passive income. Once created, digital products can be sold repeatedly without the need for additional inventory or production costs. This allows you to earn revenue 24/7, even while you sleep. With the right marketing and monetization strategies in place, digital products can become a consistent source of income and a valuable asset for your business.

Another advantage of digital products is their global reach. Unlike physical products that are limited by geographical boundaries, digital products can be accessed and purchased by customers from all around the world. This opens up new markets and enables you to tap into a larger customer base. By leveraging the power of the internet, you can expand your business and increase your revenue potential exponentially.

However, with the rise of digital products comes increased competition. To stand out in a crowded marketplace, it’s important to create high-quality products that offer unique value to your target audience. By delivering exceptional content and user experience, you can establish yourself as a trusted authority in your niche and build a loyal customer base.

Different types of digital products.

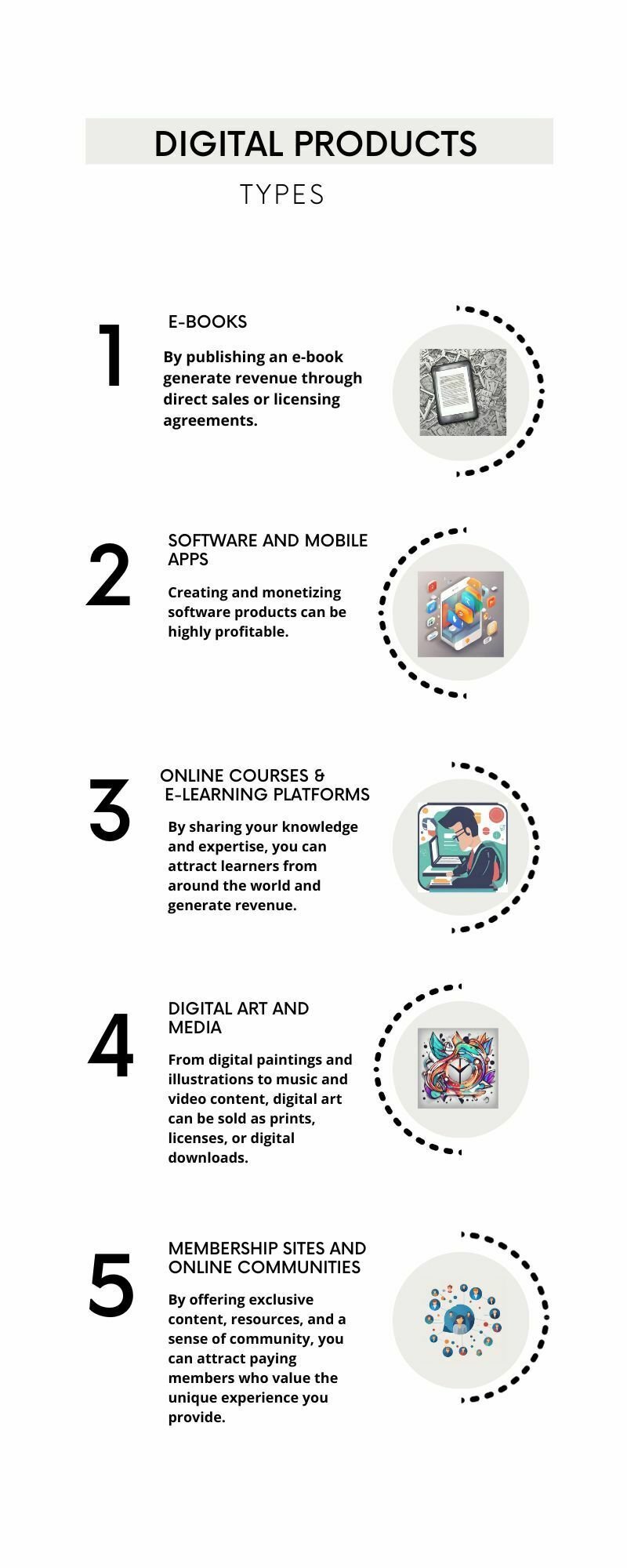

Digital products come in various forms, each with its own unique characteristics and monetization potential. Understanding the different types of digital products can help you choose the right one for your business and tailor your monetization strategy accordingly.

1. E-books and digital publications: E-books have gained immense popularity in recent years, with millions of readers opting for digital versions over traditional printed books. By publishing an e-book on a specific topic or niche, you can establish yourself as an expert and generate revenue through direct sales or licensing agreements. Digital publications, such as magazines or newsletters, offer similar monetization opportunities.

2. Software and mobile apps: Software platforms and mobile apps have revolutionized industries and transformed the way we live and work. Whether it’s a productivity tool, a gaming app, or a specialized software solution, creating and monetizing software products can be highly profitable. From one-time purchases to subscription-based models, there are various pricing options to consider.

3. Online courses and e-learning platforms: With the growing demand for online education, creating and selling online courses has become a popular monetization strategy. By sharing your knowledge and expertise, you can attract learners from around the world and generate revenue through course sales or membership subscriptions. E-learning platforms also offer opportunities for collaboration and revenue sharing with other course creators.

4. Digital art and media: The rise of digital art and media has opened up new avenues for artists and creators to monetize their work. From digital paintings and illustrations to music and video content, digital art can be sold as prints, licenses, or digital downloads. Online marketplaces and platforms dedicated to digital art provide a platform for creators to showcase and sell their work.

5. Membership sites and online communities: Building a membership site or an online community around a specific topic or interest can be a highly profitable venture. By offering exclusive content, resources, and a sense of community, you can attract paying members who value the unique experience you provide. Membership sites can be monetized through subscription fees, premium content, or additional products and services.

Each type of digital product requires a tailored monetization strategy based on its unique characteristics and target audience. By understanding the different options available, you can choose the digital product that aligns with your goals and offers the most potential for revenue generation.

Creating and developing a digital product requires careful planning and execution. To ensure its success, follow these steps:

1. Identify your target audience: Before you start creating your digital product, it’s crucial to identify your target audience. Understand their needs, pain points, and preferences to create a product that resonates with them. Conduct market research, gather feedback, and analyze competitors to gain insights into your target audience’s preferences and expectations.

2. Define your product’s unique value proposition: In a crowded marketplace, it’s essential to differentiate your digital product from the competition. Define your product’s unique value proposition – the specific benefits and advantages it offers to customers. Whether it’s solving a problem, providing convenience, or delivering exceptional quality, your product’s value proposition should be clear and compelling.

3. Plan and outline your content: For digital products such as e-books, online courses, or digital publications, planning and outlining your content is crucial. Create a detailed outline that organizes your content into logical sections or modules. This will help you ensure a smooth flow of information and make it easier for users to navigate and consume your product.

4. Create high-quality content: The success of your digital product relies heavily on the quality of its content. Whether it’s well-researched articles, engaging videos, or interactive quizzes, invest time and effort into creating high-quality content that delivers value to your audience. Consider hiring experts or collaborating with industry professionals to elevate the quality of your product.

5. Design and user experience: The design and user experience of your digital product play a vital role in its success. Pay attention to the visual elements, layout, and navigation to create an intuitive and user-friendly experience. Test your product with a focus group or beta testers to gather feedback and make necessary improvements before launching.

6. Test and iterate: Before launching your digital product, it’s essential to test it thoroughly and gather feedback from users. Conduct usability tests, gather feedback through surveys or focus groups, and make necessary improvements based on user insights. Iterating and refining your product based on user feedback will ensure its quality and enhance user satisfaction.

By following these steps, you can create a high-quality digital product that resonates with your target audience and sets the foundation for successful monetization.

Pricing strategies for digital products.

Choosing the right pricing strategy is essential for monetizing your digital product effectively. Here are some common pricing models to consider:

1. One-time purchase: This is the simplest and most straightforward pricing model, where customers pay a one-time fee to access your digital product. This model works well for products with a fixed lifespan or for customers who prefer a one-time payment instead of a recurring subscription.

2. Subscription-based membership: A subscription-based model offers customers access to your digital product for a recurring fee, typically on a monthly or annual basis. This model provides a steady stream of income and encourages customer retention. It works well for products that offer ongoing value, such as software platforms, online courses, or membership sites.

3. Freemium: The freemium model offers a basic version of your digital product for free, with the option to upgrade to a premium version for additional features or content. This model allows you to attract a larger audience and convert free users into paying customers. It works well for software products, mobile apps, and online services.

4. Tiered pricing: With tiered pricing, you offer multiple pricing options with varying levels of features or access. This allows customers to choose a plan that best suits their needs and budget. Tiered pricing is often used for software products, online services, or membership sites.

When deciding on a pricing strategy, consider factors such as the perceived value of your product, the competitive landscape, and your target audience’s willingness to pay. Test different pricing models and gather feedback to find the optimal pricing strategy that maximizes your revenue while providing value to your customers.

Marketing and promoting your digital product.

Creating a high-quality digital product is just the first step. To monetize it effectively, you need to market and promote it to your target audience. Here are some strategies to consider:

1. Content marketing: Content marketing involves creating and sharing valuable content that attracts and engages your target audience. Create blog posts, videos, or podcasts that provide insights, tips, or tutorials related to your digital product. This will help you establish yourself as an expert and generate interest in your product.

2. Social media marketing: Leverage social media platforms to promote your digital product and engage with your audience. Create compelling posts, run targeted ads, and collaborate with influencers or industry experts to expand your reach. Encourage user-generated content and testimonials to build social proof and credibility.

3. Email marketing: Build an email list of interested prospects and nurture them through targeted email campaigns. Send regular updates, exclusive offers, and valuable content to your subscribers to keep them engaged and interested in your digital product. Personalize your emails and segment your audience to deliver relevant content based on their interests and preferences.

4. Affiliate marketing: Partner with affiliates or influencers who can promote your digital product to their audience. Offer them a commission or a revenue share for each sale they generate. This can help you reach a wider audience and leverage the trust and credibility of the affiliate or influencer.

5. Search engine optimization (SEO): Optimize your website or landing page for search engines to increase organic traffic and visibility. Conduct keyword research, optimize your content, and build high-quality backlinks to improve your search engine rankings. This will drive targeted traffic to your website and increase the chances of conversions.

6. Paid advertising: Consider running paid advertising campaigns on platforms like Google Ads or social media platforms to increase visibility and reach. Set a budget, target specific keywords or demographics, and create compelling ad copy that drives clicks and conversions. Monitor and optimize your campaigns regularly to maximize your return on investment.

Remember, marketing and promotion should start well before your product launch and continue even after its release. Consistent and targeted marketing efforts will help you generate awareness, attract customers, and maximize your revenue potential.

Platforms for selling and distributing digital products.

Choosing the right platform for selling and distributing your digital product is crucial for its success. Here are some popular platforms to consider:

1. E-commerce platforms: E-commerce platforms like Shopify, WooCommerce, or BigCommerce offer robust features and integrations to sell digital products. These platforms allow you to set up an online store, manage inventory, process payments, and deliver digital downloads to customers.

2. Online marketplaces: Online marketplaces like Amazon, Etsy, or Udemy provide a ready-to-use platform to sell your digital products. These platforms have a large customer base and offer tools for marketing, customer support, and payment processing.

3. Membership site platforms: Membership site platforms like Kajabi, Teachable, or MemberPress enable you to create a dedicated membership site for your digital product. These platforms offer features like content protection, recurring billing, and member management to monetize your digital product through subscriptions.

4. Self-hosted solutions: If you prefer more control and customization, self-hosted solutions like WordPress with plugins such as Easy Digital Downloads or LearnDash allow you to sell and distribute digital products directly from your website. These solutions require more technical expertise but offer greater flexibility and customization options.

Consider factors such as ease of use, payment options, integration capabilities, and pricing when choosing a platform. Evaluate the platform’s reputation, customer support, and user reviews to ensure it meets your specific needs and aligns with your monetization strategy.

Building a loyal customer base for your digital products

Building a loyal customer base is essential for long-term success and sustainable revenue generation. Here are some strategies to build customer loyalty:

1. Provide exceptional customer experience: Focus on delivering exceptional customer service and support. Respond promptly to customer inquiries, address their concerns, and go the extra mile to exceed their expectations. Positive customer experiences will lead to repeat purchases and word-of-mouth referrals.

2. Offer personalized experiences: Tailor your digital product and marketing efforts to individual customer preferences and needs. Use data analytics and customer insights to personalize your content, recommendations, and offers. Personalization creates a more engaging and relevant experience, increasing customer satisfaction and loyalty.

3. Implement a loyalty program: Reward your loyal customers with exclusive benefits, discounts, or access to premium content. Implement a loyalty program that incentivizes repeat purchases and encourages customer retention. This can be in the form of a points system, VIP status, or tiered rewards.

4. Encourage user-generated content: Foster a sense of community and encourage customers to share their experiences with your digital product. User-generated content, such as testimonials, reviews, or case studies, builds social proof and credibility. Offer incentives or run contests to encourage customers to create and share content related to your product.

5. Continuously improve and update your product: Regularly update and improve your digital product based on customer feedback and market trends. Listen to your customers’ suggestions and address any issues or pain points. By continuously enhancing your product, you show your commitment to customer satisfaction and keep them engaged and loyal.

Remember, building customer loyalty takes time and effort. Focus on delivering value, building relationships, and providing exceptional experiences to create a loyal customer base that supports your business growth.

Tools and resources for creating and selling digital products.

Creating and selling digital products requires the right tools and resources to streamline the process. Here are some popular tools to consider:

1. Design and content creation tools: Tools like Adobe Creative Cloud, Canva, or Figma help you create visually appealing graphics, illustrations, or interactive content for your digital product. These tools offer templates, editing features, and collaboration capabilities to enhance your design workflow.

2. Content management systems (CMS): Content management systems like WordPress, Squarespace, or Wix provide a user-friendly interface to create and manage your website or landing page. These platforms offer templates, plugins, and integrations to customize your site and sell your digital products.

3. Payment gateways: Payment gateways like PayPal, Stripe, or Braintree enable secure and seamless payment processing for your digital products. These platforms offer features like recurring billing, fraud protection, and international payment support.

4. Email marketing software: Email marketing software like Mailchimp, ConvertKit, or Active