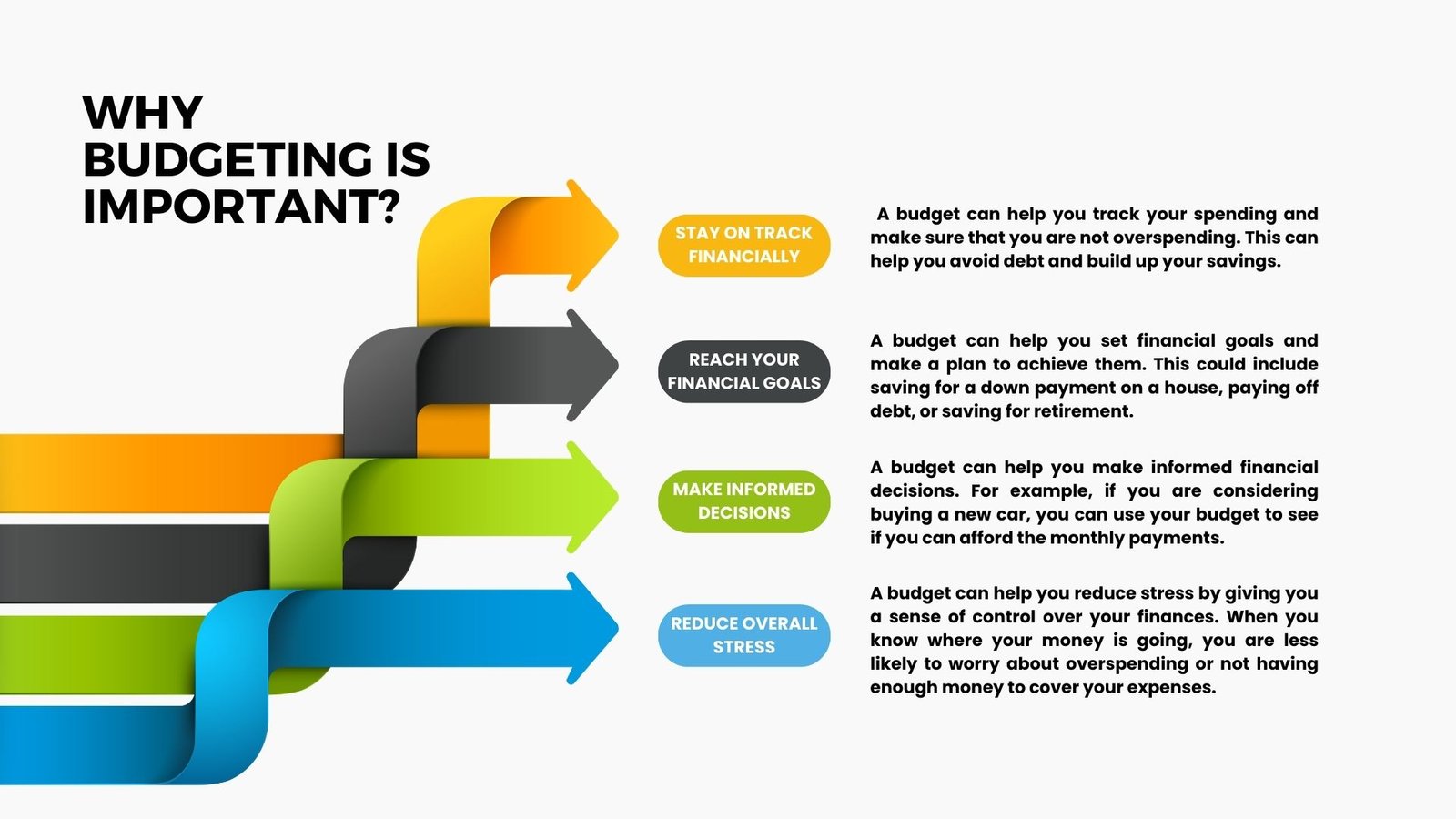

Budgeting is one of the most important financial tools you can use to achieve your financial goals. A budget helps you track your income and expenses, so you can see where your money is going and make sure you’re not overspending. It also helps you set financial goals and track your progress towards them.

However, To make sure your budget is still working for you, it is very important to review and adjust your budget in regular intervels of time. This is because your income and expenses can change over time, and you may need to make adjustments to your budget to reflect these changes. The purpose of this blog post is to provide insights on how frequently you should review and adjust your budget for successful money Security?

Why Reviewing and Adjusting your budget is so important:

1. To ensure that your budget is still realistic and achievable. As your income and expenses change, your budget may no longer be realistic or achievable. By reviewing your budget regularly, you can make sure it’s still working for you.

2. To track your progress towards your financial goals. This will help you stay motivated and on track.

3. To identify areas where you can save money. This could mean cutting back on unnecessary expenses or finding ways to reduce your spending.

- Understanding the Dynamic Nature of Budgeting

Budgeting is not a static process. It needs to evolve with changing circumstances. Life events, income changes, and financial goals can all impact the effectiveness of a budget. That’s why it’s important to be flexible and adaptable when it comes to budgeting.

1. Life events: Life events can have a significant impact on your budget. For example, if you have a child, you’ll need to factor in the cost of childcare. If you get married, you’ll need to combine your finances and create a new budget. And if you retire, you’ll need to adjust your budget to reflect your reduced income.

2. Change in income: Income changes can also impact your budget. If you get a raise, you may be able to save more money or spend more on discretionary items. However, if you lose your job, you’ll need to make some tough decisions about how to cut your spending.

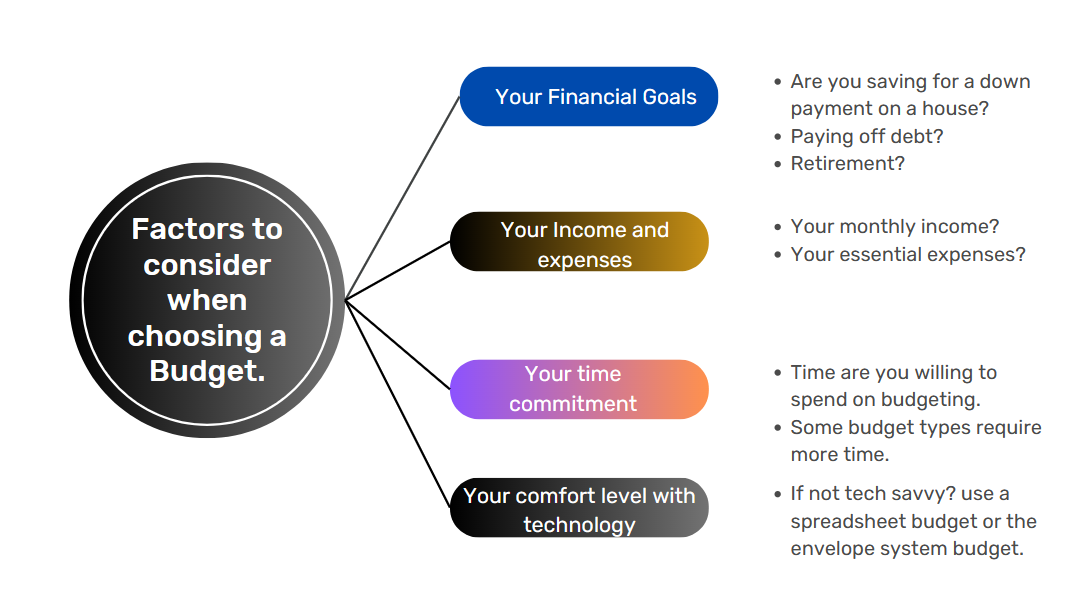

3. Financial goals: Financial goals can also impact your budget. If you’re saving for a down payment on a house, you’ll need to make sure your budget includes enough money for that goal. And if you’re saving for retirement, you’ll need to factor in the cost of living in retirement.

The key to successful budgeting is to be flexible and adaptable. As your circumstances change, you need to be willing to adjust your budget accordingly. This will help you stay on track financially and achieve your goals.

Important Tips for being flexible and adaptable when it comes to budgeting:

- Track your spending. This will help you see where your money is going and identify areas where you can cut back.

- Set financial goals. This will give you something to work towards and help you stay motivated.

- Be prepared for unexpected expenses. This could mean having an emergency fund or setting aside money each month for unexpected expenses.

- Be willing to adjust your budget as needed. This could mean cutting back on spending, increasing your income, or both.

By following these tips, you can be sure that your budget is dynamic and will adapt to your changing circumstances. This will help you stay on track financially and achieve your goals.

2. Right Frequency for Reviewing Your Budget:

The frequency with which you should review your budget depends on your individual circumstances and financial situation. However, there are some general guidelines that can help you determine the right frequency for you.

Monthly reviews: Monthly reviews are a good option for people who have a lot of variable expenses, such as those who freelance or work in commission-based sales. Monthly reviews can help you track your spending and make sure you’re not overspending in any particular category.

Quarterly reviews: Quarterly reviews are a good option for people who have more stable income and expenses. Quarterly reviews can help you make sure your budget is still on track and that you’re on track to reach your financial goals.

pros and cons of different review frequencies:

Annual reviews: Annual reviews are a good option for people who have relatively stable income and expenses and who are not saving for any specific goals. Annual reviews can help you make sure your budget is still working for you and that you’re not missing any opportunities to save money.

Pros and Cons of different review frequencies:

Monthly reviews:

- Pros:

- Can help you track your spending and make sure you’re not overspending.

- Can help you identify areas where you can save money.

- Can help you stay on track with your financial goals.

- Cons:

- Can be time-consuming.

- Can be difficult to keep up with if you have a lot of variable expenses.

Quarterly reviews:

- Pros:

- Can be less time-consuming than monthly reviews.

- Can still help you track your spending and make sure you’re not overspending.

- Can help you stay on track with your financial goals.

- Cons:

- May not be frequent enough to catch any major changes in your spending or income.

Annual reviews:

- Pros:

- Can be the least time-consuming option.

- Can still help you track your spending and make sure you’re not overspending.

- Can help you stay on track with your financial goals.

- Cons:

- May not be frequent enough to catch any major changes in your spending or income.

When choosing a review frequency, it’s important to consider your financial situation and preferences. If you have a lot of variable expenses, you may need to review your budget more frequently than someone with more stable income and expenses. And if you’re someone who likes to be organized and on top of things, you may prefer to review your budget more frequently than someone who is more laid-back.

Ultimately, the best frequency for reviewing your budget is the one that works best for you. There is no right or wrong answer, so experiment until you find a frequency that you’re comfortable with.

3. Signs that Indicate It’s Time to Adjust Your Budget:

Budgets are living documents that should be adjusted as your financial situation changes. Here are some signs that it’s time to adjust your budget:

- Your income has changed: If you’ve gotten a raise or lost your job, your budget will need to be adjusted to reflect your new income. For example If you get a raise, you may be able to increase your savings or start investing. On the other hand If you lose your job, you may need to cut back on your expenses or find a way to increase your income.

- Your expenses have changed: If you’ve had a baby, bought a new car, or started taking a night class, your budget will need to be adjusted to reflect your new expenses. If you have a baby, you’ll need to factor in the cost of childcare, diapers, and other baby expenses. In the same way If you buy a new car, you’ll need to factor in the cost of insurance, gas, and maintenance.

- Your financial goals have changed: If you’ve decided to save for a down payment on a house or pay off your student loans, your budget will need to be adjusted to reflect your new goals.

- consistently overspending: If you’re consistently overspending in one or more categories, your budget needs to be adjusted to help you reduce your spending.

- You’re not on track to reach your financial goals: If you’re not on track to reach your financial goals, your budget needs to be adjusted to help you get back on track.

If you notice any of these signs, it’s time to take a look at your budget and make some adjustments. By adjusting your budget, you can ensure that your finances are on track and that you’re on track to reach your financial goals.

Additional tips for adjusting your budget:

- Start by tracking your spending for a month or two. This will help you see where your money is going and identify areas where you can cut back.

- Once you’ve tracked your spending, make a list of your financial goals. What are you saving for? When do you want to reach your goals?

- Once you know your goals, start adjusting your budget to reflect them. This may mean increasing your savings, reducing your expenses, or both.

- Be realistic about your budget. Don’t try to cut back too much too soon, or you’ll be more likely to give up.

- Review your budget regularly and make adjustments as needed. Your financial situation is constantly changing, so your budget should change with it.

4. How to Effectively Adjust Your Budget:

Adjusting your budget can be a daunting task, but it doesn’t have to be. By following these tips, you can effectively adjust your budget and ensure that your finances are on track.

1. Start by tracking your spending for a month or two. This will help you see where your money is going and identify areas where you can cut back.

2. Once you’ve tracked your spending, make a list of your financial goals. What are you saving for? When do you want to reach your goals?

3. Once you know your goals, start adjusting your budget to reflect them. This may mean increasing your savings, reducing your expenses, or both.

4. Be realistic about your budget. Don’t try to cut back too much too soon, or you’re more likely to give up.

5. Review your budget regularly and make adjustments as needed. Your financial situation is constantly changing, so your budget should change with it.

How to modify budget categories and allocations:

- Start by reviewing your budget and identifying areas where you can cut back. This could include things like eating out less, canceling unused subscriptions, or shopping around for cheaper car insurance.

- Once you’ve identified areas where you can cut back, start reallocating those funds to your financial goals. This could mean increasing your savings, paying down debt, or saving for a specific purchase.

- Be sure to factor in any upcoming expenses, such as annual insurance premiums or car registration fees. This will help you avoid overspending in the future.

- Review your budget regularly and make adjustments as needed. Your financial situation is constantly changing, so your budget should change with it.

How to set new financial goals and priorities during the adjustment process:

- Take some time to think about your short-term and long-term financial goals. What do you want to achieve with your money?

- Once you know your goals, prioritize them. Which goals are most important to you?

- Once you’ve prioritized your goals, adjust your budget to reflect them. This may mean increasing your savings for your down payment, paying down debt faster, or saving for a vacation.

- Be flexible with your goals. Your financial situation may change, so be prepared to adjust your goals accordingly.

Here is some guidance on reallocating funds to ensure that essential expenses and savings are adequately addressed:

- Start by listing all of your essential expenses, such as housing, food, transportation, and insurance.

- Once you’ve listed your essential expenses, add up the total amount. This is the amount of money you need to allocate to these expenses each month.

- Once you know how much money you need to allocate to essential expenses, start reallocating funds from other categories. This could mean eating out less, canceling unused subscriptions, or shopping around for cheaper car insurance.

- Be sure to leave some money for savings. Even if it’s just a small amount, saving money each month will help you reach your financial goals.

5. Build and maintain an emergency fund.

What is an emergency fund?

An emergency fund is a pool of money that you set aside to cover unexpected expenses. This could include things like car repairs, medical bills, or job loss. Having an emergency fund can help you avoid going into debt when unexpected expenses arise.

How can an emergency fund help with budgeting adjustments?

An emergency fund can help you with budgeting adjustments in a few ways. First, it can give you the peace of mind to make changes to your budget without worrying about how you’re going to pay for unexpected expenses. Second, it can provide you with the financial flexibility to make changes to your budget without compromising your long-term financial goals.

For example, let’s say you have a budget that allocates $100 per month to entertainment. However, you realize that you can cut back on entertainment expenses and save that money instead. If you have an emergency fund, you can make this change to your budget without worrying about how you’re going to pay for unexpected expenses. You can use the money you save from entertainment to build up your emergency fund or to start saving for a long-term goal, such as a down payment on a house.

How to build and maintain an emergency fund:

The amount of money you need in an emergency fund will vary depending on your individual circumstances. However, a good rule of thumb is to have enough money to cover 3-6 months of living expenses.

There are a few different ways to build an emergency fund.

- Start small and save consistently. You can start by setting aside a small amount of money each month. Even if you can only save $50 per month, it will add up over time. You can also look for ways to cut back on your expenses so that you can save more money.

- Automate your savings. This will help you make sure that you’re saving money each month, even if you forget.

- Look for ways to cut back on your expenses. This could mean eating out less, canceling unused subscriptions, or shopping around for cheaper car insurance.

- Make sure your emergency fund is accessible. This means keeping it in a savings account or money market account where you can easily access it if you need it.

Once you have an emergency fund, it’s important to maintain it. This means adding money to your fund each month and making sure that the money is accessible in case of an emergency. It can help you avoid going into debt when unexpected expenses arise and it can give you the peace of mind to make changes to your budget without compromising your long-term financial goals.

6. Seeking Professional Guidance

Budgeting adjustments can be complex, especially if you are dealing with a lot of different variables. In these cases, it can be helpful to seek professional advice from a financial planner or advisor. A financial planner can help you assess your current financial situation, create a budget that meets your individual needs, and make adjustments to your budget as needed.

Scenarios where expert guidance can be beneficial in optimizing budget adjustments

- When you are facing a major life change, such as a job loss or a new baby. These events can have a significant impact on your finances, and it can be helpful to have a financial planner who can help you make the necessary adjustments to your budget.

- When you are trying to achieve a specific financial goal, such as saving for a down payment on a house or retirement. A financial planner can help you create a plan that will help you reach your goal on time and within your budget.

- When you are simply feeling overwhelmed by your finances. If you are feeling lost or confused about your finances, a financial planner can help you get back on track.

you can find a reputable financial advisor by asking for referrals from friends, family, or colleagues. Do your research online. There are many websites that can help you compare financial advisors and find one who is a good fit for you. Once you have found a few potential advisors, schedule an interview with each one. This will give you a chance to ask questions and see if they are a good fit for you.

Some additional tips on finding a reputable financial advisor:

- Make sure the advisor is a fiduciary. This means that they are legally obligated to act in your best interests.

- Ask about the advisor’s fees. Financial advisors typically charge a fee for their services. Make sure you understand what the fees are and how they will be calculated.

- Get everything in writing. Once you have chosen an advisor, make sure you get everything in writing. This includes the advisor’s fees, their investment philosophy, and their service agreement.

Conclusion

Key takeaways from this blog:

- Regularly review your budget. This should be done at least once a month, but more often if your income or expenses are volatile.

- Be open to making changes to your budget. If your income or expenses change, you may need to adjust your budget accordingly.

- Be proactive in managing your budget. Don’t wait until you are in financial trouble to start managing your budget.

- Track your spending. This will help you see where your money is going and identify areas where you can cut back.

- Set financial goals. Having specific goals will help you stay motivated and on track.

- Be realistic about your budget. Don’t try to cut back too much too soon, or you’ll be more likely to give up.

- Seek professional guidance if needed. If you are struggling to manage your budget, a financial advisor can help you get back on track.

Remember, regular budget reviews and adjustments are vital for successful financial planning and achieving long-term financial goals. So don’t be afraid to make changes to your budget as needed. Your financial future will thank you for it.