Do you ever wonder where your money goes? Do you feel like you’re constantly broke, even though you have a job? If so, you’re not alone. Millions of people struggle with their finances.

Welcome to our comprehensive guide on budgeting, where we delve into the world of financial management and empower you to take control of your money. Budgeting is more than just a way to track your expenses; it’s a powerful tool that can transform your financial life. Whether you’re looking to achieve specific financial goals, reduce debt, or simply gain a better understanding of your spending habits, budgeting is the key to unlocking financial success. In this blog, we will explore the importance of budgeting, different types of budgets, how to stick to your budget, and the wide-ranging benefits it offers. Get ready to embark on a journey towards financial empowerment as we navigate the ins and outs of budgeting and guide you towards a brighter financial future.

What is Budgeting?

Budgeting is a financial planning process that outlines how income will be earned and allocated to cover various expenses, savings, and investments. It involves strategies, estimating and tracking income sources, such as salaries, business profits, or government funds, and determining how that income will be distributed across different categories of expenses, such as housing, transportation, food, entertainment, and making adjustments as needed.

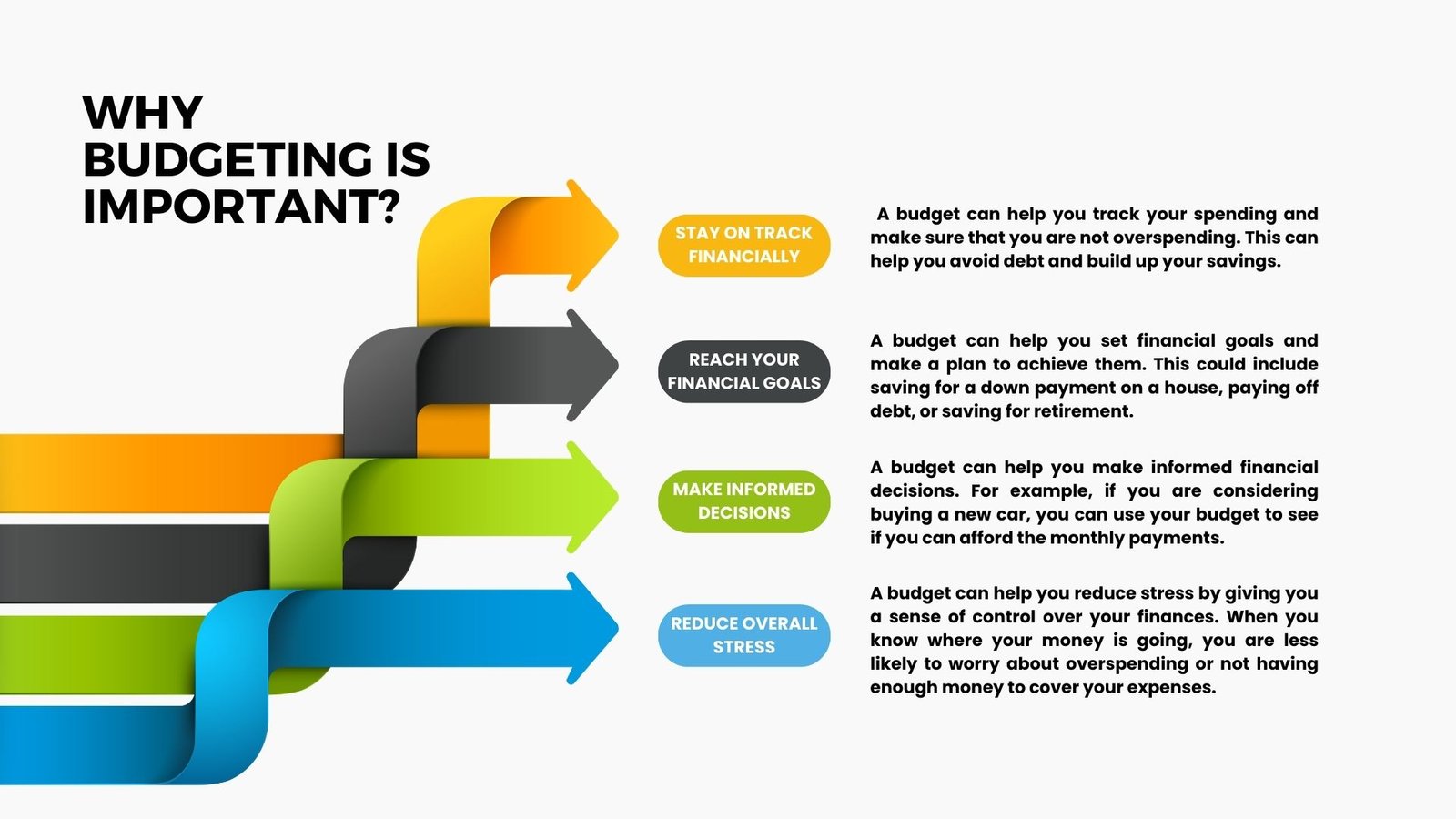

Benefits of Budgeting

Budgeting offers several benefits that contribute to effective financial management:

Improved Financial Control: Budgeting provides a clear picture of income and expenses, allowing individuals and entities to have better control over their finances. It helps avoid overspending, stay within financial limits, and prevent unnecessary debt accumulation.

Goal Achievement: By setting financial goals within a budget, individuals and entities can work towards specific objectives. Budgeting allows for the allocation of funds towards savings, debt repayment, investments, and other financial aspirations.

Debt Management: A budget assists in managing and reducing debt effectively. It helps prioritize debt repayments, avoid late payment fees, and develop strategies to pay off debt faster. This leads to improved financial health and reduced interest costs.

Savings and Emergency Preparedness: Budgeting encourages the habit of saving money. It facilitates the allocation of funds towards savings goals, such as building an emergency fund for unexpected expenses. This provides financial security and peace of mind.

Financial Awareness and Decision-Making: Budgeting promotes financial awareness by tracking income and expenses. It allows individuals and entities to identify spending patterns, analyze cost-saving opportunities, and make informed decisions about financial priorities.

Planning for the Future: Budgeting involves forecasting and planning for future financial needs and

Kickstart Budgeting

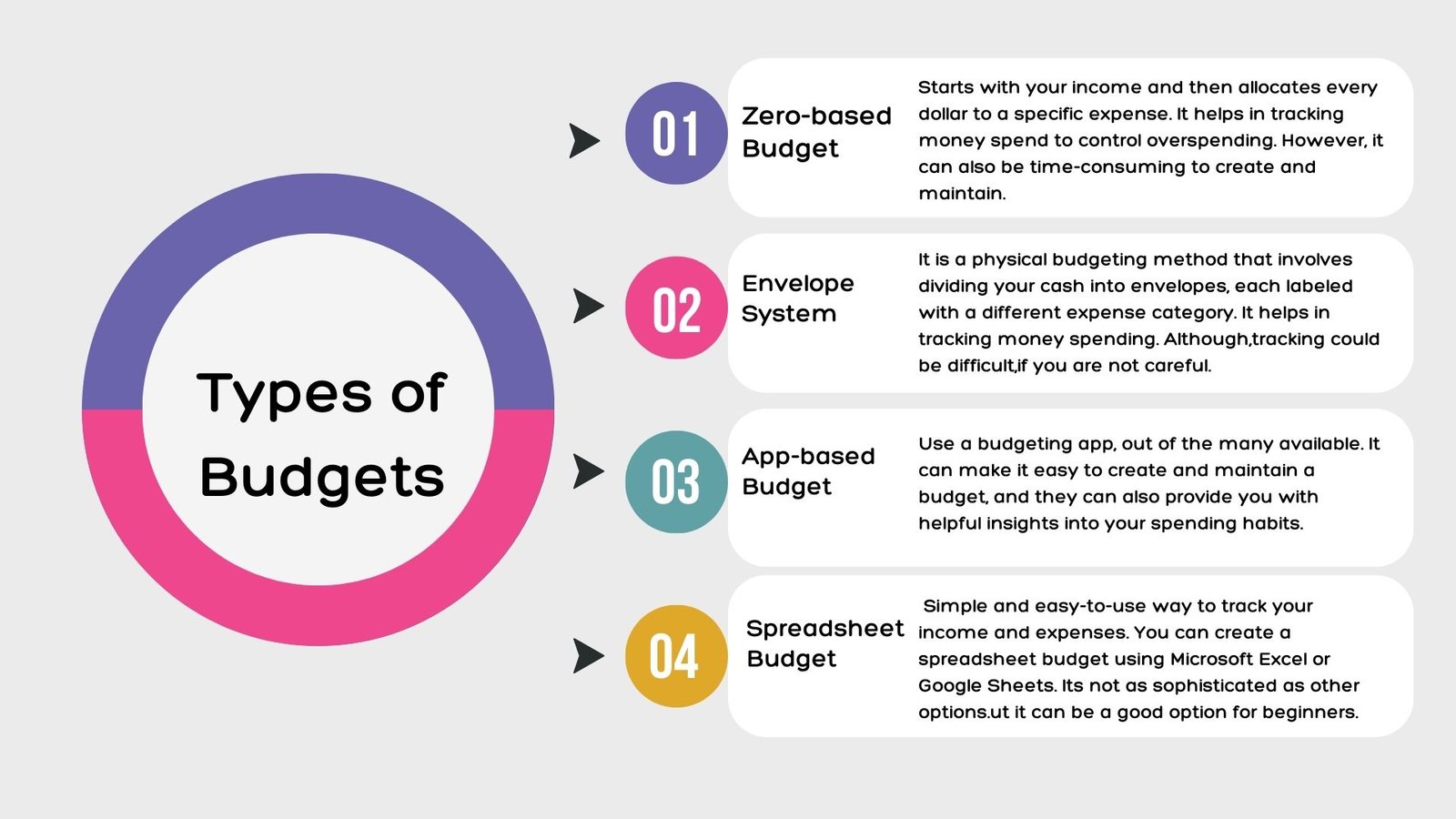

What are the different types of Budgets?

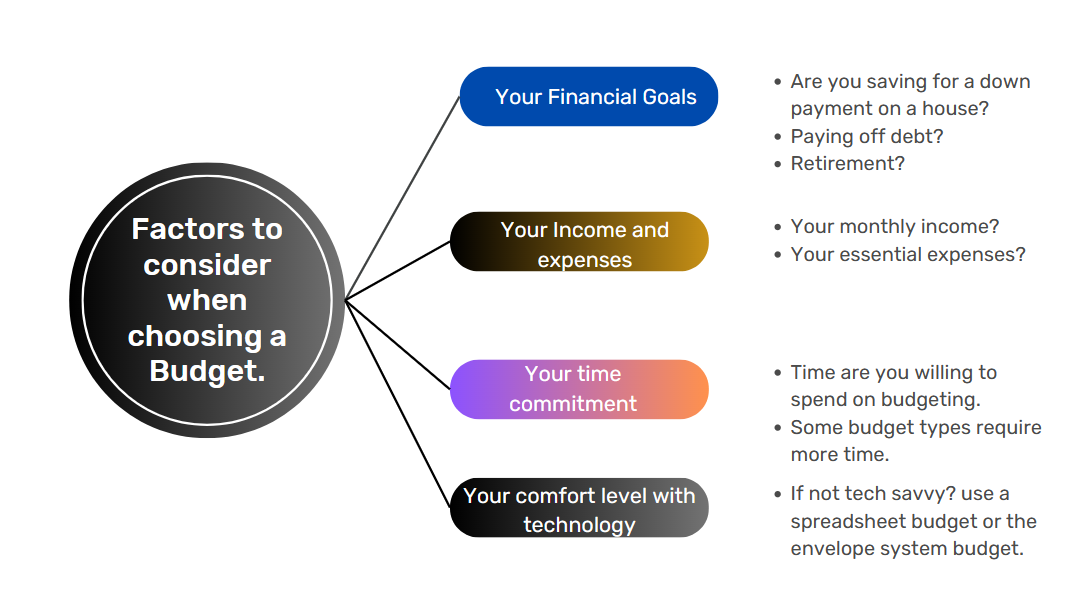

How to choose the right Budget type for you?

No matter what type of budget you choose, the most important thing is to stick to it. If you find that you are not sticking to your budget, you may need to adjust it or choose a different type of budget.

Important Budgeting tips for beginners

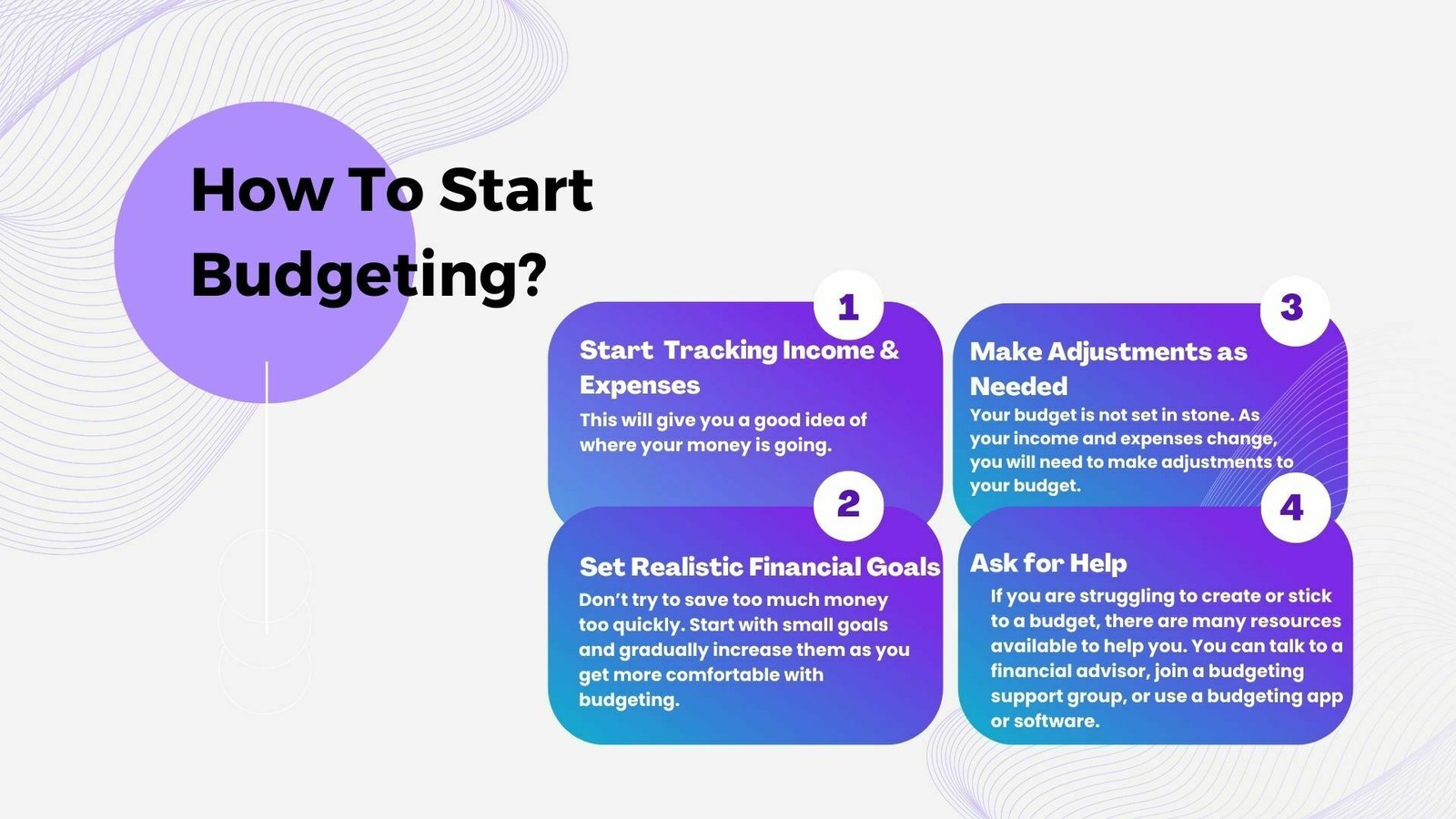

Here are some budgeting tips for beginners:

- Start by tracking your income and expenses: This will give you a good idea of where your money is going. You can use a budgeting app, spreadsheet, or even just a piece of paper to track your spending.

- Set realistic financial goals: Don’t try to save too much money too quickly. Start with small goals and gradually increase them as you get more comfortable with budgeting.

- Make adjustments as needed: Your budget is not set in stone. As your income and expenses change, you will need to make adjustments to your budget.

- Don’t be afraid to ask for help: If you are struggling to create or stick to a budget, there are many resources available to help you. You can talk to a financial advisor, join a budgeting support group, or use a budgeting app or software.

How to Stick to your budget

- Automate your savings: If you can, set up automatic transfers from your checking account to your savings account. This will help you save money without even thinking about it.

- Pay yourself first: When you get paid, put some money aside for savings before you pay any of your bills. This will help you stay on track with your financial goals.

- Avoid impulse purchases: If you see something you want to buy, wait 24 hours before you buy it. This will give you time to think about whether you really need it or not.

- Find ways to cut back on unnecessary expenses: Do you really need that expensive cable package? Could you cook more meals at home instead of eating out? There are many ways to cut back on your expenses without sacrificing your quality of life.

- Reward yourself: When you stick to your budget, reward yourself with something you enjoy. This will help you stay motivated and on track.

Budgeting can be a challenge, but it is worth it. By following these tips, you can create a budget that will help you reach your financial goals and reduce stress.

Conclusion

Budgeting is an essential part of financial planning. It can help you track your spending, save for your goals, and stay out of debt. There are many different types of budgets, so you can find one that fits your individual needs and preferences.

If you’re new to budgeting, start by setting realistic goals. Then, track your spending for a month or two to get an idea of where your money is going. Once you know where your money is going, you can start to make adjustments to your budget.

Sticking to your budget can be challenging, but it’s worth it. When you stick to your budget, you’ll have financial peace of mind, increased savings, reduced debt, and better financial decision-making.

The benefits of budgeting extend beyond financial stability. It fosters financial awareness, enabling you to understand your spending habits, identify areas for improvement, and make adjustments as needed. Budgeting also promotes responsible financial behavior, helping you develop healthy money management habits that can positively impact your future.

Remember, budgeting is a dynamic process. It may require periodic adjustments as your financial circumstances change. Stay proactive, review your budget regularly, and adapt it to reflect your evolving needs and goals.

By embracing budgeting as a powerful tool, you are taking control of your financial future. So, start budgeting today and unlock the potential for financial freedom and success.

Happy budgeting!