Introduction

Greetings, readers! In the dynamic world of finance and investment, equity finance plays a pivotal role in shaping the destiny of companies and entrepreneurs alike. In this blog post, we delve into the intricate realm of equity finance, exploring its nuances, benefits, and how it can be a game-changer for businesses seeking to scale new heights.

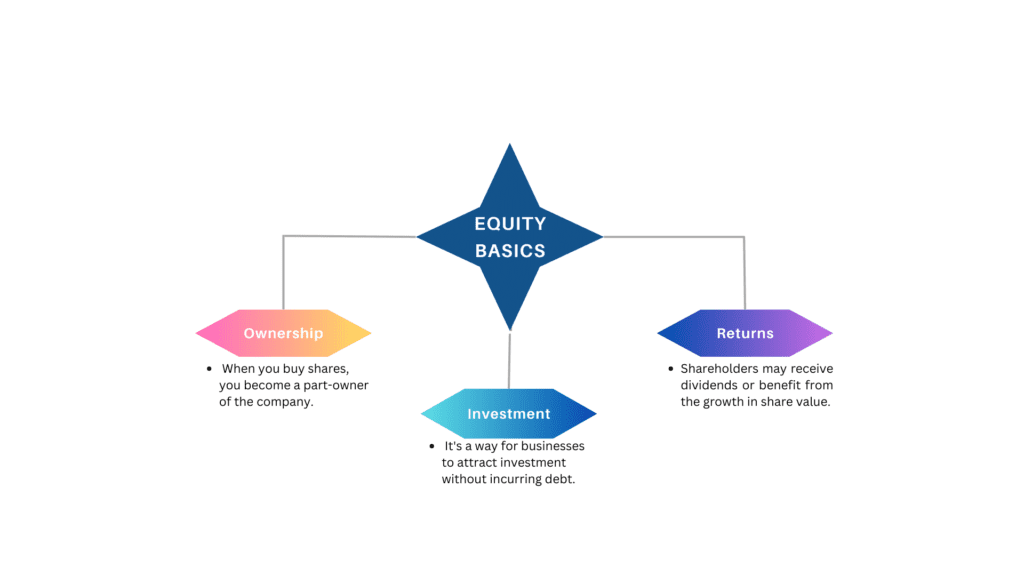

Understanding Equity Finance

Equity finance, often referred to as equity funding, involves raising capital by selling a portion of ownership (equity shares) in a company to investors. This form of financing not only provides the necessary funds for growth and expansion but also establishes a vested interest for investors in the success of the company. Unlike debt financing, equity financing doesn’t accrue interest or require regular repayments. Instead, investors become stakeholders, sharing in the company’s profits and losses.

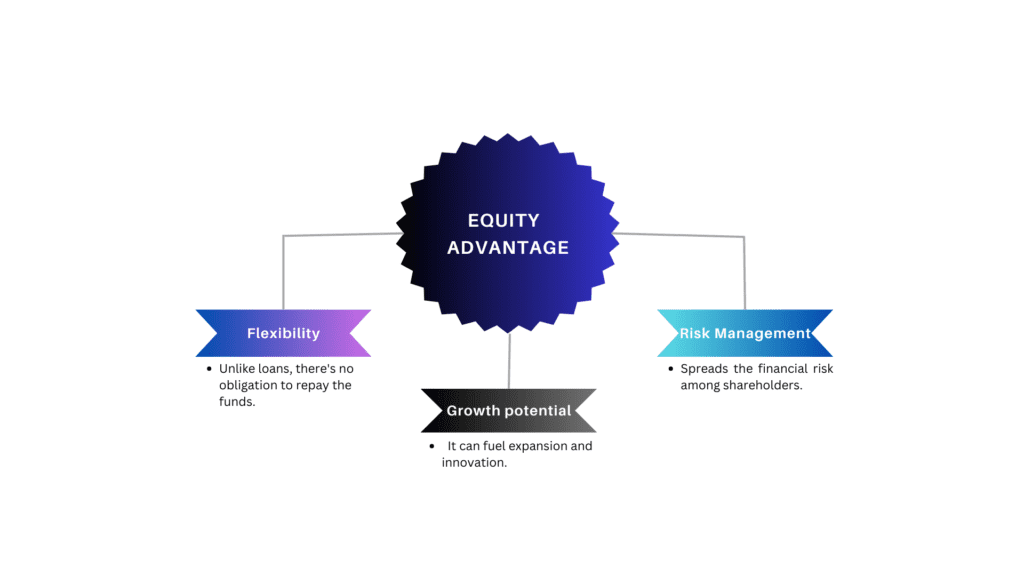

Benefits of Equity Finance:

- Shared Risk and Reward: Equity investors share both the risks and rewards of the business. This alignment of interests fosters a strong partnership between entrepreneurs and investors.

- Long-Term Capital: Equity funding provides access to long-term capital that can fuel sustained growth initiatives, research and development, and market expansion.

- Expertise and Networks: Beyond funds, equity investors often bring valuable industry expertise and networks to the table, helping the company make strategic decisions and open new avenues.

- Flexibility: Equity financing doesn’t come with fixed repayment schedules. This flexibility allows companies to focus on growth without the pressure of immediate debt obligations.

Equity Finance Strategies:

- Venture Capital (VC): Startups with high growth potential often seek VC funding. VC firms invest in exchange for equity and play an active role in shaping the company’s direction.

- Private Equity (PE): PE firms invest in established companies looking to scale further. They may take a controlling stake and work on operational improvements to enhance value.

- Initial Public Offering (IPO): Going public through an IPO is a significant milestone. It allows companies to raise substantial capital from the public markets in exchange for equity shares.

- Angel Investors: Individual investors, often with industry experience, provide seed funding to startups in exchange for equity. They can act as mentors to early-stage entrepreneurs.

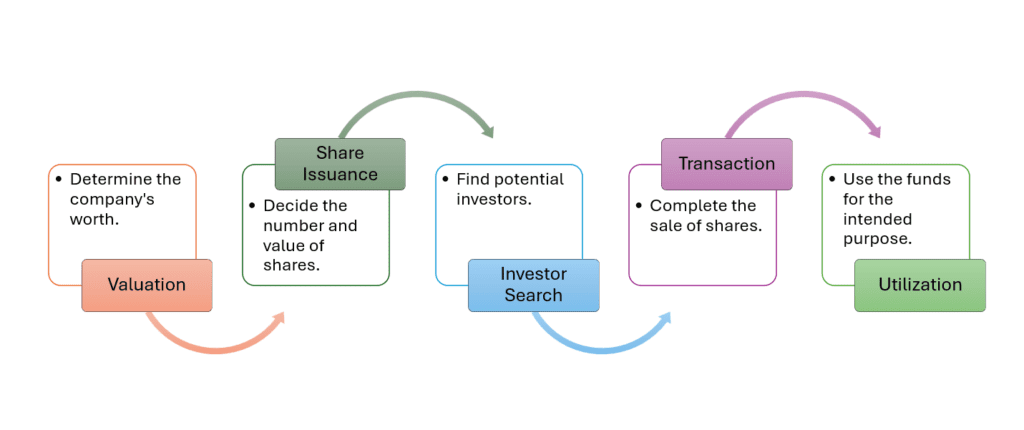

Equity Financing step by step

Navigating Challenges

While equity finance offers numerous benefits, it’s essential to navigate potential challenges:

- Dilution of Ownership: Issuing new equity shares can dilute the ownership stake of existing shareholders, including founders.

- Loss of Control: Depending on the extent of equity sold, entrepreneurs may relinquish some control over business decisions.

- Valuation Complexities: Determining the right valuation for the company can be challenging, impacting the terms of equity issuance.

Conclusion

Equity finance serves as a powerful tool for companies aspiring to realize their growth potential. By attracting investment from individuals and institutions who believe in their vision, businesses can secure the capital and support needed to turn dreams into reality. From startups aiming to disrupt industries to established firms seeking to expand their horizons, equity finance stands as a cornerstone of modern business success.

Remember, each business’s journey is unique, and understanding the balance between equity and control is crucial. So, whether you’re a budding entrepreneur or a seasoned business leader, consider the possibilities that equity finance can unlock on your path to prosperity.

Thank you for joining us on this exploration of equity finance. Stay tuned for more insights into the world of finance, investing, and growth. If you have any questions or thoughts, feel free to share them in the comments below. Until next time!