Investing in the stock market can be a daunting task, especially if you’re a beginner. The world of stocks, shares, and market trends can seem overwhelming and confusing. But fear not! In this article, we will provide essential tips that will help you invest with confidence and navigate the stock market like a pro.

Whether you’re looking to grow your wealth, save for retirement, or achieve a specific financial goal, investing in stocks can be a powerful tool. However, it’s important to approach the stock market with knowledge and understanding. That’s why we’ve compiled a list of crucial tips that every beginner should know.

From understanding the basics of investing to conducting thorough research, managing risk, and diversifying your portfolio, we’ve got you covered. We’ll equip you with the knowledge and strategies necessary to make informed investment decisions and mitigate potential pitfalls.

So, if you’re ready to embark on your stock market journey and achieve your financial goals, keep reading. With our essential tips, you’ll gain the confidence to navigate the stock market and make wise investment choices.

What is stock market?

The stock market is a complex and dynamic system where shares of publicly traded companies are bought and sold. It serves as a platform for investors to trade securities and for companies to raise capital. Understanding the stock market is crucial for any beginner investor.

To begin, it’s important to understand that the stock market is influenced by various factors, including economic indicators, company performance, market sentiment, and geopolitical events. These factors can cause stock prices to fluctuate, creating opportunities for investors.

Furthermore, the stock market is divided into different exchanges, such as the New York Stock Exchange (NYSE) and the Nasdaq, BSE,NSE etc. Each exchange has its own listing requirements and trading rules, so it’s important to familiarize yourself with the exchange where you plan to invest.

Finally, it’s important to note that investing in the stock market involves risks. Stock prices can be volatile, and there is always a chance of losing money. However, with proper knowledge and strategies, you can minimize risks and increase your chances of success.

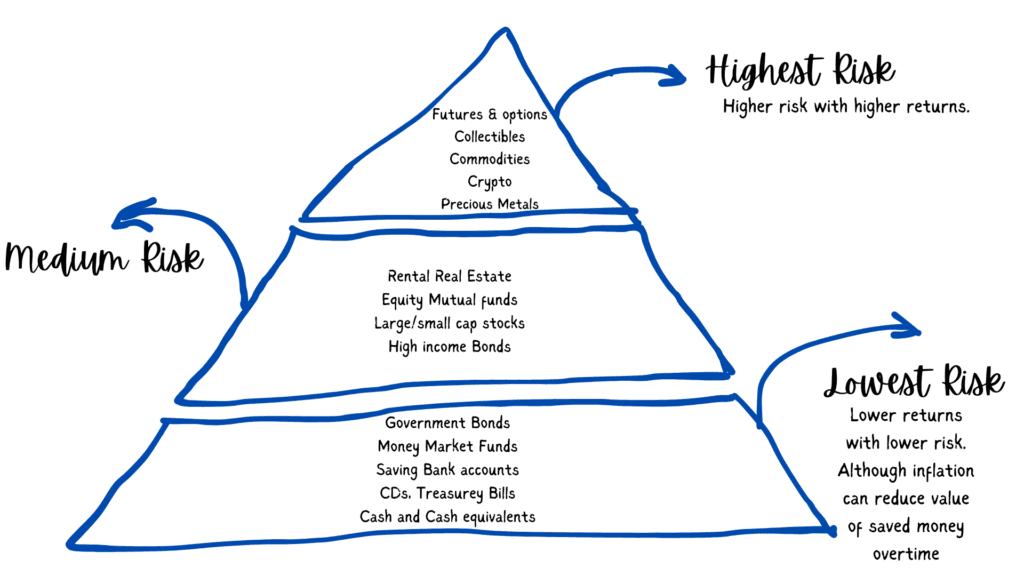

Risk Pyramid of Investments

The pyramid gives hierarchy of investment assets based on the classic definition of investment risk, which is measured in volatility. Volatility refers to the extent and the rapidity of changes in the value of an investment. The assets are categorized into four risk levels: higher, medium, low, and lowest risk.

Higher Risk

This category includes assets that are known for significant price fluctuations over short periods. These are generally suitable for more aggressive investors who can tolerate higher levels of risk and are looking for higher returns. For example:

- Futures and Options are derivative instruments that can be highly leveraged, leading to larger gains or losses.

- Commodities and Precious Metals can be affected by a wide range of factors including market demand, geopolitical stability, and currency values.

- Crypto assets are known for their extreme volatility and are influenced by market sentiment, regulatory news, and technology changes.

Medium Risk

This category is for those looking for growth but with a moderate level of risk.

- Rental Real Estate provides income through rent and potential appreciation, but also involves operational and market risks.

- Growth Stocks are from companies expected to grow at an above-average rate compared to other companies, but they can be volatile.

- Small Company Stocks can offer high growth potential but can also be more volatile and less liquid.

- Medium-rated Bonds have moderate credit risk and offer higher yields than higher-rated bonds.

- Mutual Funds can offer diversification but still carry risks depending on their investment focus.

- Investment Grade Bonds are issued by reliable entities and carry lower risk of default.

- US Treasury Bonds and Notes are backed by the U.S. government, hence considered safe with a stable return.

Low Risk

These assets are generally considered safer and more stable, suitable for conservative investors.

- Savings Accounts and Money Market Funds offer low returns but high liquidity and safety.

- Certificates of Deposit (CDs) are time deposits with fixed interest rates and are insured up to a certain amount.

- US Treasury Bills and Fixed Annuities are low-yield but are considered very safe investments.

Key insights for investors from this hierarchy include the importance of matching one’s risk tolerance and investment horizon to the appropriate category of assets. A diversified portfolio typically includes a mix of asset classes to balance the overall risk and return. It is also crucial to understand that higher risk assets, while offering the potential for higher returns, can lead to significant losses and therefore should be approached with caution and ideally, with a well-thought-out investment strategy.

Benefits of Investing in Stocks

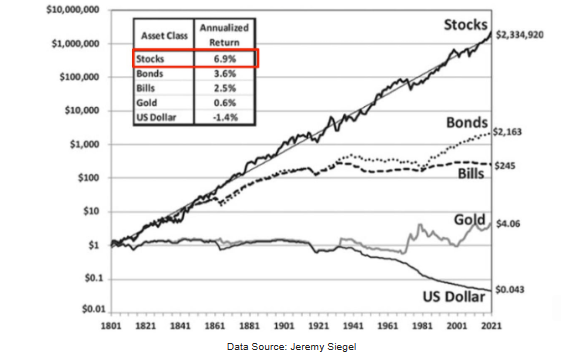

Investing in the stock market offers several benefits that can help you achieve your financial goals. Above chart shows U.S. stock market has consistently outperformed every other asset class.

Here are some key advantages of investing in stocks:

1. Potential for high returns: Historically, the stock market has provided higher returns compared to other investment options, such as bonds or savings accounts. By investing in well-performing companies, you have the potential to grow your wealth significantly.

2. Dividend income: Many companies share a portion of their profits with shareholders through dividends. By investing in dividend-paying stocks, you can earn a regular income stream in addition to potential capital gains.

3. Ownership and voting rights: When you invest in stocks, you become a partial owner of the company. This means you have certain rights, such as voting on important company decisions and receiving annual reports. Owning stocks allows you to participate in the success of the company.

4. Liquidity: Unlike some other investments, stocks are highly liquid, meaning they can be bought and sold quickly. This allows you to access your funds whenever you need them, providing flexibility and financial security.

While investing in stocks has many advantages, it’s important to remember that there are no guarantees in the stock market. Prices can fluctuate, and past performance is not indicative of future results. It’s essential to conduct thorough research and make informed decisions.

Common misconceptions about stock market investing

Before diving into the essential tips for beginner investors, let’s address some common misconceptions about stock market investing. These misconceptions often prevent people from taking advantage of the opportunities offered by the stock market. Let’s debunk them:

1. Investing is only for the wealthy: Many people believe that investing in the stock market is only for the wealthy. However, this is not true. You can start investing with as little as a few hundred dollars. There are various investment options available, including low-cost index funds and fractional shares.

2. Investing is gambling: Some people equate investing in stocks to gambling. While there is always a level of risk involved, investing is not purely based on luck. It requires research, analysis, and a long-term perspective. With proper knowledge and strategies, you can make informed investment decisions.

3. You need to time the market: Timing the market refers to trying to buy stocks at the lowest price and sell at the highest price. This is extremely difficult, if not impossible, to consistently achieve. Instead of trying to time the market, focus on long-term investing and selecting fundamentally strong companies.

4. Investing is too complicated: The stock market can seem complicated, especially to beginners. However, with the right approach and knowledge, investing can be simplified. By understanding the basics, conducting thorough research, and following a disciplined investment strategy, you can navigate the stock market with confidence.

Now that we’ve addressed these misconceptions, let’s dive into the essential tips for beginner investors.

Essential tips for beginner investors

Setting financial goals and assessing risk tolerance

Before you start investing, it’s important to set clear financial goals and assess your risk tolerance. Determine what you want to achieve through investing and how much risk you’re willing to take. This will help you make appropriate investment decisions.

Investing in the stock market can be a rewarding journey for beginner investors. By understanding the basics, conducting thorough research, managing risk, and diversifying your portfolio, you can invest with confidence and work towards achieving your financial goals.

Remember, investing is not a one-time event but a continuous process. Stay informed, adapt to changing market conditions, and seek professional advice when needed. With time, patience, and the right strategies, you can grow your wealth and achieve financial success through stock market investing.

So, don’t let the fear of the unknown hold you back. Take the first step towards investing with confidence and embark on your stock market journey.

Choosing the right investment strategy

To invest with confidence, it’s crucial to start by choosing the right investment strategy. There are various approaches to investing in the stock market, and finding the one that aligns with your financial goals and risk tolerance is essential.

1. Determine Your Financial Goals: Before diving into the stock market, take some time to identify your financial goals. Are you looking for long-term growth, income, or a combination of both? Understanding your objectives will help you select the most suitable investment strategy.

2. Assess Your Risk Tolerance: Risk tolerance refers to your ability to handle potential losses. It’s crucial to honestly evaluate how comfortable you are with taking risks. A higher risk tolerance may lead you to pursue more aggressive investment strategies, while a lower risk tolerance may lead you to opt for more conservative approaches.

3. Consider Your Time Horizon: Your time horizon is the length of time you plan to hold your investments. If you have a longer time horizon, you may be able to withstand short-term market volatility and focus on long-term growth. However, if you have a shorter time horizon, you may need to prioritize capital preservation and income generation.

By considering these factors, you can narrow down the investment strategies that are most suitable for your individual circumstances. Whether it’s value investing, growth investing, or dividend investing, selecting the right strategy lays the foundation for successful investing.

Researching and selecting stocks

Once you have a clear investment strategy in mind, the next step is to research and select individual stocks. Conducting thorough research is essential for making informed investment decisions and building a well-rounded portfolio.

1. Understand the Company: Before investing in a stock, it’s crucial to understand the company behind it. Look into their business model, financials, competitive advantage, and growth prospects. Consider factors such as revenue growth, profitability, and market share.

2. Analyze the Industry: Assessing the industry in which the company operates is also important. Is it a growing industry with favorable long-term prospects? Are there any regulatory or competitive risks that could impact the company’s performance? Understanding the industry dynamics can help you gauge the potential for growth and profitability.

3. Evaluate Financial Metrics: Financial metrics provide valuable insights into a company’s financial health. Key metrics to consider include earnings per share (EPS), price-to-earnings (P/E) ratio, return on equity (ROE), and debt levels. These metrics can help you assess the company’s profitability, valuation, and overall financial stability.

By conducting thorough research and analysis, you can identify stocks that align with your investment strategy and have the potential for long-term growth. Keep in mind that investing in individual stocks carries risks, so diversification is crucial to mitigate potential losses.

Diversification and portfolio management

Diversification is a key principle in investing that helps manage risk and optimize returns. By spreading your investments across different asset classes, sectors, and geographic regions, you can reduce the impact of any single investment on your overall portfolio.

1. Asset Allocation: Start by determining your asset allocation, which refers to how you distribute your investments across different asset classes such as stocks, bonds, and cash. The right asset allocation depends on your risk tolerance, financial goals, and time horizon. A well-diversified portfolio typically includes a mix of asset classes.

2. Sector Allocation: Within the stock market, it’s important to diversify across different sectors. This helps reduce the impact of any sector-specific risks on your portfolio. Consider allocating your investments across sectors such as technology, healthcare, consumer goods, and finance.

3. Geographic Allocation: Another aspect of diversification is spreading your investments across different geographic regions. Investing in international markets can provide exposure to different economies and reduce the risk of being overly dependent on a single market.

Regularly reviewing and rebalancing your portfolio is also crucial. As market conditions change, some investments may outperform while others may underperform. By rebalancing, you can bring your portfolio back in line with your desired asset allocation and take advantage of new opportunities.

Monitoring and adjusting your investments

Once you’ve built your portfolio, it’s important to monitor your investments and make any necessary adjustments. Staying informed about market trends and company news can help you make timely decisions and maximize your returns.

1. Stay Informed: Keep up-to-date with market news, economic indicators, and company-specific developments. Tools such as financial news websites, stock market apps, and company reports can provide valuable insights. Regularly reading and staying informed will help you make informed investment decisions.

2. Set Realistic Expectations: Understand that the stock market can be volatile, and short-term price fluctuations are normal. Set realistic expectations and focus on long-term trends and fundamentals rather than day-to-day market movements. This will help you avoid making impulsive investment decisions based on short-term market noise.

3. Reassess Your Strategy: Periodically reassess your investment strategy to ensure it aligns with your changing financial goals, risk tolerance, and market conditions. As your circumstances evolve, you may need to make adjustments to your asset allocation, sector allocation, or individual stock holdings.

Conclusion

Remember, investing is a long-term journey, and patience is key. By monitoring your investments and making informed adjustments, when necessary, you can stay on track to achieve your financial goals.

Frequently Asked Questions (FAQs)

- How Should a Beginner Start Investing?

Starting your investment journey can seem daunting, but it’s really about taking those first steps. For beginners, it’s essential to begin with understanding your financial goals and risk tolerance. Research different investment options, start with small amounts, and consider diversified investments to spread risk.

- How Much Should a First-Time Investor Invest?

The golden rule for first-time investors is to invest only what you can afford to lose. There’s no one-size-fits-all amount, but a good starting point could be a small percentage of your savings. It’s more about learning the ropes and understanding the market dynamics than the amount invested.

- What Are the Key Steps for a Beginner to Start Investing?

A beginner should start by educating themselves about different types of investments (stocks, bonds, mutual funds, etc.). Setting clear investment goals. Determining their risk tolerance. Starting small to gain experience. Monitor your investments and readjust.

- How Much Do Beginner Investors Typically Make?

The returns on investments can vary widely. It depends on the types of investments, market conditions, and the level of risk taken. Beginners might see modest gains initially as they navigate the learning curve. Remember, investing is more of a marathon than a sprint.

- What’s a Good Amount for a Beginner to Start Investing With?

There’s no definitive answer but starting with a comfortable amount that won’t impact your daily finances is advisable. Some people start with as little as $50 or $100, investing in stocks or mutual funds, to get a feel for the market.

- Where Should a Beginner Investor Start?

Beginner investors should start with setting clear financial goals, gaining basic financial literacy, choosing a reputable online broker or investment platform. Considering starting with low-cost index funds or robo-advisors for guided investing.

- What Should a Beginner Investor Invest In?

For beginners, it’s wise to start with investments that are less risky and more straightforward. Index funds, mutual funds, and ETFs (Exchange-Traded Funds) are great starting points as they offer diversification and lower risk compared to individual stocks.