Are you tired of trading your time for money? Imagine making money while you sleep, travel, or simply enjoy life. This is possible through passive income. In this article, we will explore how to get started with passive income and discover financial freedom.

Passive income is money earned with little to no effort on your part. It is not a get-rich-quick scheme but rather an investment of time and effort upfront, with the potential for ongoing income in the long run. Whether you are looking to supplement your current income or build a full-fledged business, passive income can provide a valuable source of financial stability.

In this comprehensive guide, we will cover various passive income streams, including real estate investments, affiliate marketing, creating and selling digital products, and more. We will delve into the benefits and potential risks of each method and provide actionable steps to help you get started.

If you are ready to escape the cycle of trading time for money, join us as we unravel the secrets of passive income and pave the way towards financial independence. Let’s dive in and discover the possibilities that await on your path to making money while you sleep.

What is passive income?

Passive income is money earned with little to no effort on your part. It is not a get-rich-quick scheme but rather an investment of time and effort upfront, with the potential for ongoing income in the long run. The key difference between passive income and active income is that active income requires you to exchange your time and effort for money, whereas passive income generates income even when you’re not actively working.

There are various forms of passive income, such as rental income from real estate properties, dividends from stocks, royalties from books or music, affiliate marketing, and creating and selling digital products. The beauty of passive income is that it allows you to break free from the limitations of traditional employment and opens up the possibility of earning money 24/7, regardless of your location or activity.

The benefits of earning passive income

Earning passive income offers numerous benefits that can significantly improve your financial situation and overall quality of life.

- Financial freedom: Passive income provides a sense of security and financial stability. It allows you to build wealth and diversify your income sources, reducing reliance on a single paycheck.

- Flexibility and time freedom: By generating passive income, you can free up your time and have the flexibility to spend it on things that truly matter to you. Whether it’s pursuing hobbies, spending time with loved ones, or traveling the world, passive income gives you the freedom to live life on your own terms.

- Potential for exponential growth: Unlike a traditional job where your income is often limited by a fixed salary, passive income has the potential for exponential growth. With the right strategies and investments, your passive income can increase over time, providing a higher return on your initial efforts.

- Diversification and risk mitigation: Relying solely on a single source of income can be risky. Creating multiple streams of passive income allows you to diversify your earnings and reduce the impact of economic downturns or unexpected events.

Common types of passive income streams

There are several popular passive income streams that you can explore to generate ongoing income. Let’s take a closer look at some of them:

1. Real estate investments

Investing in real estate properties, such as rental properties or vacation rentals, can be an excellent way to generate passive income. By renting out your properties, you can earn a steady stream of rental income while potentially benefiting from property appreciation over time. Real estate investments require upfront capital and diligent property management, but they can provide stable and long-term passive income.

2. Dividend stocks and index funds

Investing in dividend stocks or index funds allows you to earn passive income through regular dividend payments. Dividend stocks are shares of companies that distribute a portion of their profits to shareholders, while index funds are investment funds that track a specific market index. By investing in these assets, you can benefit from regular dividend payments without actively managing individual stocks.

3. Affiliate marketing

Affiliate marketing involves promoting other people’s products or services and earning a commission for each sale or lead generated through your referral. This can be done through blog posts, social media, or email marketing. Affiliate marketing is a popular passive income stream for bloggers, influencers, and content creators, as it allows them to monetize their platforms and earn income while providing value to their audience.

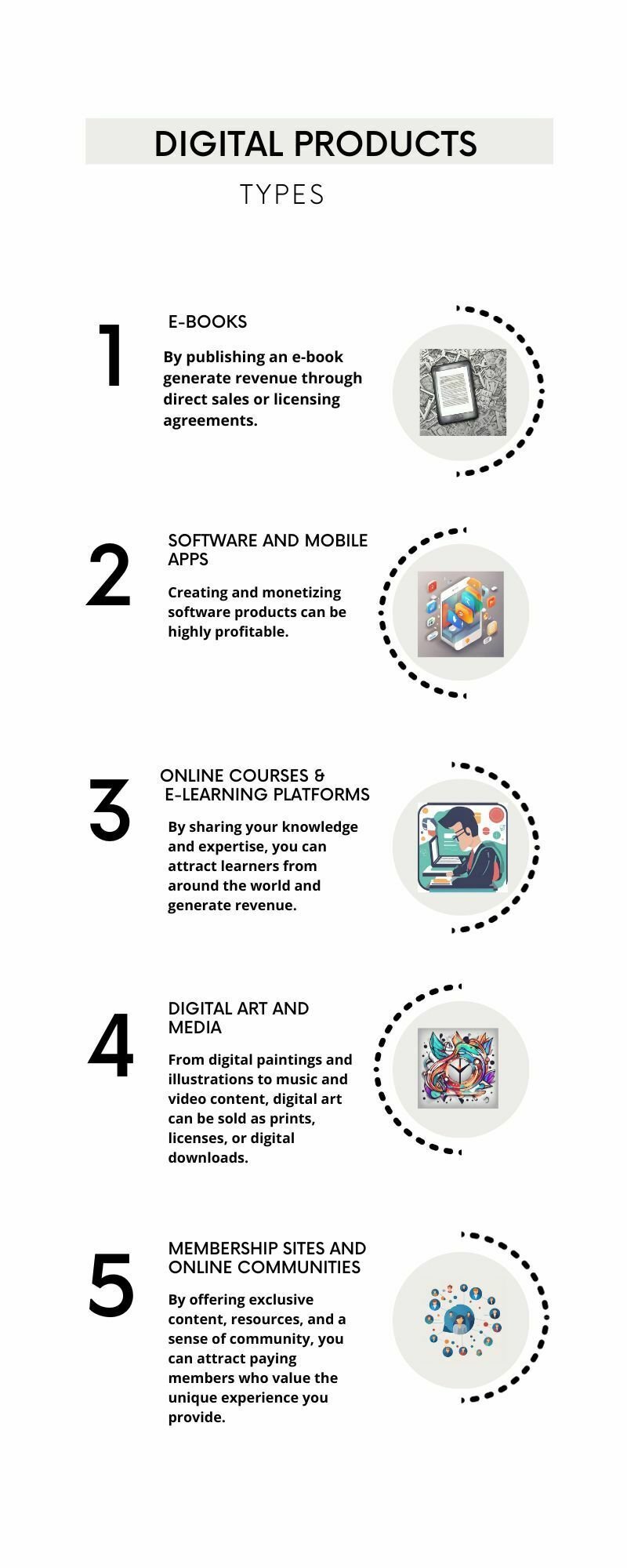

4. Creating and selling digital products

In the digital age, creating and selling digital products is a lucrative passive income opportunity. This can include e-books, online courses, stock photos, software, or even music. Once you create the product, you can sell it repeatedly without the need for additional production costs. With the right marketing strategies and platforms, you can reach a wide audience and generate passive income from your digital creations.

These are just a few examples of passive income streams, but the possibilities are endless. The key is to find a method that aligns with your interests, skills, and resources, and then take consistent action to build and grow your passive income streams.

How to get started with passive income?

Getting started with passive income requires careful planning and execution. Here are some steps to help you embark on your passive income journey:

1. Assess your financial situation and goals

Take a close look at your current financial situation, including your income, expenses, and debts. Determine your short-term and long-term financial goals, such as paying off debts, saving for retirement, or achieving financial independence. Understanding your goals will help you prioritize and focus on the passive income streams that align with your objectives.

2. Educate yourself about passive income opportunities

Research different passive income streams and educate yourself about their potential benefits, risks, and requirements. Read books, listen to podcasts, and join online communities to learn from experts and successful individuals who have achieved passive income success. Building knowledge and understanding will empower you to make informed decisions and avoid common pitfalls.

3. Create a passive income plan

Develop a comprehensive plan that outlines your passive income goals, strategies, and action steps. Identify the specific methods you want to pursue, along with the investment or time commitment required for each. Set realistic expectations and timelines, and regularly review and adjust your plan as needed.

4. Start small and scale up

It’s important to start with manageable and achievable goals when beginning your passive income journey. Choose one or two passive income streams to focus on initially, and gradually scale up as you gain experience and confidence. This will allow you to learn and adapt without overwhelming yourself or spreading your resources too thin.

5. Take consistent action and track progress

Success in passive income requires consistent action and perseverance. Take concrete steps towards implementing your passive income plan, whether it’s researching investment opportunities, creating content, or building an online platform. Track your progress, celebrate small wins, and stay motivated by visualizing the long-term benefits of passive income.

Passive income ideas for beginners

If you’re new to the concept of passive income, here are some beginner-friendly ideas to get you started:

1. Peer-to-peer lending

Peer-to-peer lending platforms allow you to lend money to individuals or small businesses in exchange for interest payments. This can be done through online platforms that connect borrowers and lenders. While there are risks involved, peer-to-peer lending can provide a relatively passive way to earn interest income.

2. Rent out a spare room or property

If you have a spare room or property, consider renting it out on platforms like Airbnb or VRBO. This can be a flexible and profitable way to earn passive income, especially if you live in a popular tourist destination or a city with high demand for short-term rentals.

3. Create an online course

If you have expertise in a particular field or skill, consider creating an online course to share your knowledge with others. Platforms like Udemy or Teachable provide a user-friendly interface for creating and selling online courses. Once the course is created, you can earn passive income from course sales without ongoing effort.

4. Invest in dividend-paying stocks or funds

Investing in dividend-paying stocks or funds can be a relatively passive way to earn regular income. Research companies with a history of consistent dividend payments and consider diversifying your investments across different sectors to mitigate risk.

These are just a few ideas to spark your creativity. Remember to choose passive income streams that align with your interests, skills, and resources. Experiment, learn from your experiences, and be open to adapting your strategies as you progress on your passive income journey.

Passive income through investments

Investing in various assets can be a powerful way to generate passive income. Here are some investment options to consider:

1. Real estate investment trusts (REITs)

Real estate investment trusts (REITs) are companies that own, operate, or finance income-generating real estate. By investing in REITs, you can gain exposure to the real estate market without the need for direct property ownership. REITs typically distribute a majority of their income to shareholders in the form of dividends.

2. Dividend-focused mutual funds or ETFs

Mutual funds and exchange-traded funds (ETFs) that focus on dividend-paying stocks can be an attractive option for passive income investors. These funds pool money from multiple investors and invest in a diversified portfolio of dividend stocks. By investing in these funds, you can benefit from regular dividend income without the need for individual stock selection.

3. Peer-to-peer lending platforms

As mentioned earlier, peer-to-peer lending platforms allow individuals to lend money to borrowers in exchange for interest payments. By diversifying your lending portfolio across multiple borrowers, you can potentially earn a steady stream of passive income from interest payments.

4. High-yield savings accounts and certificates of deposit (CDs)

While not as high-risk or high-reward as other investment options, high-yield savings accounts and CDs can provide a safe and relatively passive way to earn interest income. Look for accounts or CDs with competitive interest rates and consider locking in longer-term CDs to maximize your returns.

Remember, investing always carries a degree of risk, and it’s important to do thorough research, diversify your investments, and consult with a financial advisor if needed.

Building an online business for passive income

In the digital age, building an online business can be a highly profitable and flexible way to generate passive income. Here are some steps to help you get started:

1. Identify your niche and target audience

Choose a niche or topic that you’re passionate about and that has a market demand. Research your target audience and identify their pain points, needs, and desires. This will help you create valuable content and products that resonate with your audience.

2. Create valuable content

Content is the foundation of any successful online business. Create high-quality and valuable content that educates, entertains, or solves problems for your target audience. This can be in the form of blog posts, videos, podcasts, or social media content. By consistently providing value, you can attract and build an engaged audience.

3. Monetize your platform

Once you have built an audience, explore different monetization strategies that align with your niche and audience preferences. This can include affiliate marketing, sponsored content, selling digital products, offering coaching or consulting services, or even creating a membership site. Experiment with different strategies and find the ones that work best for your business model.

4. Automate and outsource

To truly achieve passive income, it’s important to automate and outsource certain aspects of your online business. Use tools and software to streamline processes, automate email marketing, and manage customer relationships. Delegate tasks that are outside your expertise or consume too much time, such as graphic design, content editing, or customer support.

Building an online business takes time, effort, and dedication, but it can provide a scalable and profitable source of passive income in the long run.

Passive income success stories

To inspire you on your passive income journey, here are a few success stories from individuals who have achieved financial independence through passive income:

1. Pat Flynn – Smart Passive Income

Pat Flynn is an entrepreneur and the founder of Smart Passive Income, a popular online platform that provides resources and inspiration for building passive income streams. Pat started his journey after being laid off from his architecture job and turned to online business as a way to support his family. Today, he earns a significant passive income through his blog, podcast, online courses, and affiliate marketing.

2. Michelle Schroeder-Gardner – Making Sense of Cents

Michelle Schroeder-Gardner is a personal finance blogger who has achieved remarkable success with her blog, Making Sense of Cents. Through her blog, Michelle shares her personal finance journey, including how she paid off $38,000 in student loans and now earns a six-figure monthly passive income through various sources, including affiliate marketing and sponsored content.

3. Patrice Washington – Real Money Answers

Patrice Washington is a financial expert, author, and podcast host who teaches people how to build wealth and achieve financial freedom. After experiencing financial struggles herself, Patrice turned her life around and now earns passive income through her books, online courses, speaking engagements, and coaching programs.

These success stories demonstrate that with the right mindset, strategies, and consistent effort, anyone can achieve financial independence through passive income. Learn from these individuals, but remember that your path may be unique, and it’s important to stay focused on your goals and take action.

Conclusion

Passive income is not a magic solution that will make you rich overnight, but it is a powerful tool that can provide financial stability, flexibility, and freedom. By diversifying your income sources and investing your time and resources wisely, you can create a solid foundation for passive income generation.

In this article, we explored the concept of passive income, its benefits, and common types of passive income streams. We discussed how to get started with passive income, including creating a passive income plan and exploring beginner-friendly ideas. We also explored passive income through investments and building an online business. Lastly, we drew inspiration from successful individuals who have achieved financial independence through passive income.

Now it’s time for you to take action. Assess your financial situation, set your goals, and start exploring the passive income opportunities that resonate with you. Remember that building passive income takes time, effort, and persistence, but the rewards can be life-changing. So, dive in and discover the possibilities that await on your path to making money while you sleep. Your financial freedom begins now.