Are you ready to unlock the potential of affiliate marketing and start earning passive income? Look no further because this ultimate guide has got you covered. In this comprehensive article, we’ll walk you through the ins and outs of affiliate marketing, equipping you with the knowledge and strategies you need to succeed in this lucrative industry.

Whether you’re a beginner looking to dip your toes into the world of affiliate marketing or a seasoned pro wanting to level up your game, this guide will provide you with invaluable insights. From understanding the fundamentals of affiliate marketing to finding the right products and platforms to promote, we’ll show you step-by-step how to create a successful affiliate marketing business.

Discover how to effectively optimize your website, leverage social media channels, and craft compelling content to drive targeted traffic to your affiliate links. Learn the secrets of building strong relationships with affiliate networks and merchants, and discover the power of analytics in tracking your performance and maximizing your earnings.

Get ready to embark on an exciting journey towards financial freedom through affiliate marketing. Let’s dive in and start earning that passive income you’ve always dreamed of!

What is affiliate marketing?

Affiliate marketing is a performance-based marketing strategy where individuals or businesses promote products or services for a commission. Essentially, you become a partner or affiliate of a company and earn a commission for every sale or lead generated through your referral.

Affiliate marketing works by providing you with a unique affiliate link that tracks the traffic and sales you generate. When someone clicks on your affiliate link and makes a purchase, you earn a percentage of the sale. This means you don’t have to worry about creating or delivering the product – your main focus is driving traffic and conversions.

How does affiliate marketing work?

The process of affiliate marketing can be broken down into four key steps:

1. Choose a niche: Start by selecting a niche or industry that aligns with your interests and expertise. This will make it easier for you to create content and promote products that resonate with your target audience.

2. Find affiliate programs: Once you’ve identified your niche, research and join affiliate programs that offer products or services relevant to your audience. Look for programs with attractive commission rates, reliable tracking systems, and good reputation.

3. Create content: Develop high-quality content that educates and engages your audience. This can include blog posts, product reviews, tutorials, videos, or social media content. Incorporate your affiliate links naturally within your content to encourage clicks and conversions.

4. Promote your content: Share your content through various channels such as your website or blog, social media platforms, email newsletters, or even paid advertising. The goal is to drive targeted traffic to your affiliate links and encourage people to make a purchase.

Benefits of affiliate marketing

Affiliate marketing offers several benefits that make it an attractive business opportunity:

1. Passive income: Once you’ve set up your affiliate marketing business and created valuable content, you can earn passive income as your content continues to drive traffic and generate sales. This means you can earn money even while you sleep or take a vacation.

2. Low startup costs: Unlike traditional businesses that require substantial capital investment, affiliate marketing has low entry barriers. You don’t need to create or stock products, handle customer support, or worry about shipping logistics. All you need is a computer, internet connection, and the ability to create compelling content.

3. Flexibility and freedom: Affiliate marketing allows you to work from anywhere in the world and set your own schedule. You have the freedom to choose the products you want to promote and the strategies you want to implement. This flexibility gives you the opportunity to create a business that aligns with your lifestyle and goals.

Common affiliate marketing terms and definitions

To navigate the world of affiliate marketing, it’s important to familiarize yourself with common terms and definitions:

1. Affiliate: The individual or business that promotes products or services in exchange for a commission.

2. Merchant: The company or business that sells the products or services being promoted by affiliates.

3. Affiliate network: An intermediary platform that connects affiliates with merchants and facilitates the tracking and payment of commissions.

4. Commission: The percentage or fixed amount earned by an affiliate for each sale or lead generated through their referral.

5. Conversion rate: The percentage of visitors who take the desired action, such as making a purchase or filling out a form, after clicking on an affiliate link.

Choosing the right affiliate marketing niche

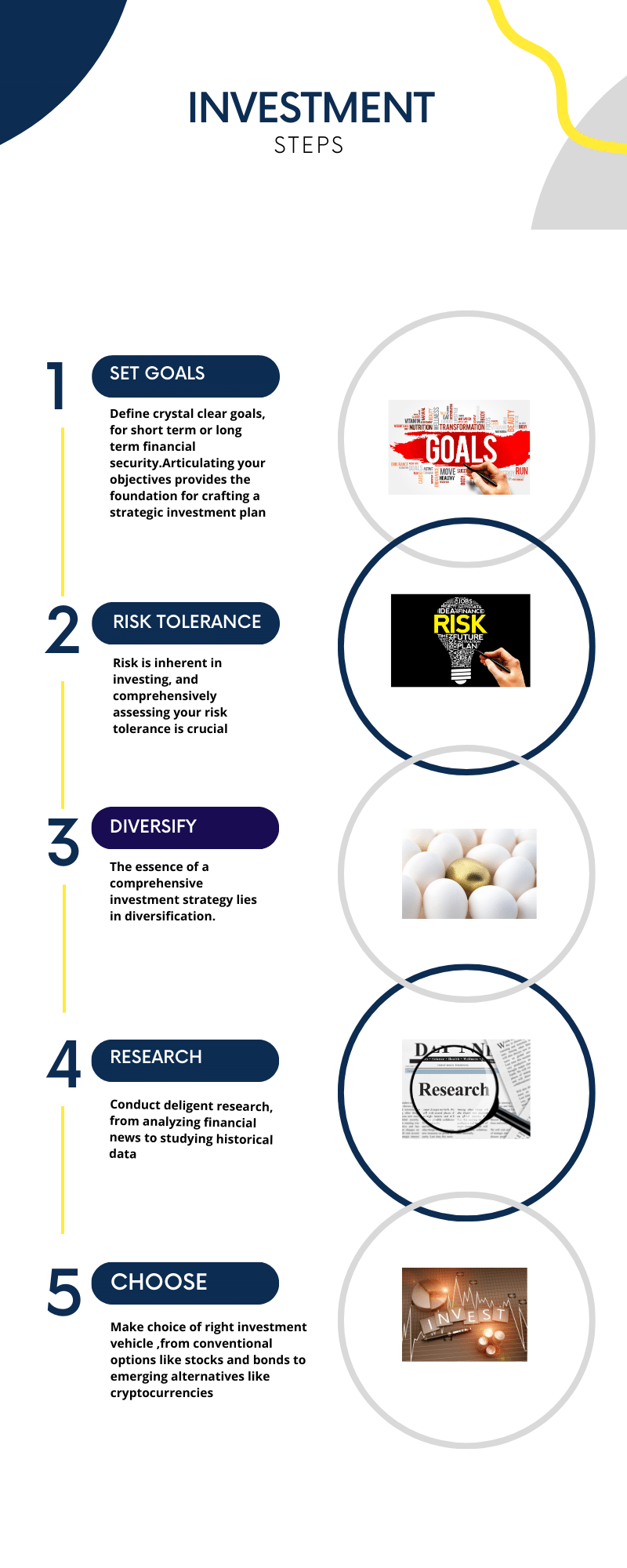

Selecting the right niche is crucial for your affiliate marketing success. Here are some tips to help you choose the right niche:

1. Passion and interest: Choose a niche that you are passionate about or have a genuine interest in. This will make it easier for you to create content and engage with your audience.

2. Profitability: Ensure that your chosen niche has a large enough audience and sufficient demand for products or services. Conduct market research to identify profitable niches with good affiliate programs.

3. Competition: Consider the level of competition in your chosen niche. While competition shows that there is potential for profit, too much competition can make it difficult to stand out. Find a balance between demand and competition.

Remember, your niche should be a combination of your passion, profitability, and the needs of your target audience.

Finding and joining affiliate programs

Once you’ve identified your niche, it’s time to find and join affiliate programs that align with your chosen industry. Here’s how you can go about it:

1. Research: Use search engines and affiliate program directories to find relevant affiliate programs. Look for programs that offer products or services that are complementary to your niche.

2. Evaluate program features: Consider factors such as commission rates, cookie duration, payment methods, and tracking reliability. Look for programs that provide comprehensive reporting and support.

3. Read reviews and testimonials: Get insights from other affiliates who have experience with the program. Look for programs with positive reviews and a good reputation.

4. Apply to affiliate programs: Once you’ve identified suitable programs, submit your application. Some programs may have specific requirements or restrictions, so ensure you meet the criteria.

Remember, it’s important to join programs that are reputable and offer products or services that align with your audience’s needs.

Creating content for affiliate marketing

Creating valuable and engaging content is key to attracting and converting your audience. Here are some content creation tips for affiliate marketing:

1. Know your audience: Understand your target audience’s needs, desires, and pain points. Create content that addresses these needs and provides solutions.

2. Provide value: Focus on creating high-quality, informative, and entertaining content. Your content should offer value to your audience and establish you as an authority in your niche.

3. Use a variety of content formats: Experiment with different content formats such as blog posts, videos, podcasts, infographics, or social media posts. This will cater to different preferences and help you reach a wider audience.

4. Incorporate affiliate links naturally: Avoid being overly promotional or pushy with your affiliate links. Integrate them organically within your content, ensuring they add value and relevance to your audience.

Remember, creating authentic and valuable content is crucial for building trust with your audience and driving conversions.

Promoting affiliate products effectively

Promoting affiliate products effectively requires a strategic approach. Here are some tips to help you maximize your promotional efforts:

1. Focus on quality over quantity: Instead of bombarding your audience with numerous affiliate links, focus on promoting high-quality products that you genuinely believe in. This will build trust and credibility.

2. Leverage multiple channels: Utilize various marketing channels such as your website or blog, social media platforms, email newsletters, and paid advertising. Each channel has its strengths and can help you reach different segments of your audience.

3. Craft compelling call-to-actions: Encourage your audience to take action by using persuasive call-to-actions. Clearly communicate the benefits and value of the product, and provide a sense of urgency or scarcity to drive conversions.

4. Utilize product reviews: Writing detailed and honest product reviews can be highly effective in persuading your audience to make a purchase. Include personal experiences, pros and cons, and any other relevant information that will help your audience make an informed decision.

Remember, promoting affiliate products effectively requires a combination of targeted marketing strategies and persuasive content.

Tracking and analyzing affiliate marketing performance

Tracking and analyzing your affiliate marketing performance is crucial for optimizing your strategies and maximizing your earnings. Here’s how you can effectively track and analyze your performance:

1. Use tracking tools: Utilize tracking tools provided by affiliate networks or consider using third-party tracking software. These tools allow you to monitor clicks, conversions, and sales generated through your affiliate links.

2. Analyze conversion rates: Regularly analyze your conversion rates to identify which products or promotions are performing well and which ones need improvement. This will help you optimize your content and promotional strategies.

3. Track traffic sources: Understand where your traffic is coming from by analyzing your referral sources. This will help you identify which marketing channels are most effective and where you should focus your efforts.

4. Monitor earnings and payments: Keep a close eye on your earnings and ensure that you are being paid accurately and on time. If you notice any discrepancies, reach out to the affiliate program or network for clarification.

Remember, tracking and analyzing your performance allows you to make data-driven decisions and continuously improve your strategies.

Scaling your affiliate marketing business

Once you’ve established a successful affiliate marketing business, you can scale your efforts to increase your income potential. Here are some strategies to help you scale your business:

1. Expand your content: Create more high-quality content to attract a larger audience and reach new markets. Consider outsourcing content creation or collaborating with other content creators to increase your output.

2. Diversify your income streams: Look for additional affiliate programs or explore other monetization methods such as sponsored content, digital products, or online courses. This will allow you to generate income from multiple sources.

3. Automate and outsource tasks: Identify repetitive or time-consuming tasks and automate or outsource them. This will free up your time to focus on high-value tasks such as content creation and strategy development.

4. Build strategic partnerships: Collaborate with other affiliates, influencers, or industry experts to expand your reach and access new audiences. Joint ventures or affiliate partnerships can help you leverage each other’s strengths and grow together.

Remember, scaling your affiliate marketing business requires careful planning, continuous optimization, and a willingness to adapt to market trends.

References

- Affiliate Marketing for Dummies by Ted Sudol and Paul Mladjenovic:

- Affiliate Marketing: Proven Step-by-Step Guide to Make Passive Income by Mark Smith:

- Affiliate Marketing Made Simple: A Step-by-Step Guide by Neil Patel:

- Affiliate Marketing 101: Learning the Basics (HubSpot):

- Affiliate Marketing: The Complete 2021 Guide (Shopify):

- The Definitive Guide to Affiliate Marketing (Backlinko):

- Affiliate Marketing: The Ultimate Guide for 2021 (Ahrefs):

- Affiliate Marketing: How to Start a Profitable Online Business (Affilorama):

- Commission Junction (CJ) Blog:

- Affiliate Marketing Subreddit (r/AffiliateMarketing):

- Affiliate Marketing Forums:

- Affiliate Marketing Networks: